Hutchinson county assessor's office services. Property tax on this property for city purposes would be:

Our Free Online Sales Tax Calculator Calculates Exact Sales Tax By State County City Or Zip Code County Sales Tax South Dakota

Convenience fees = 2.35% and will appear on your credit card statement as a separate charge.

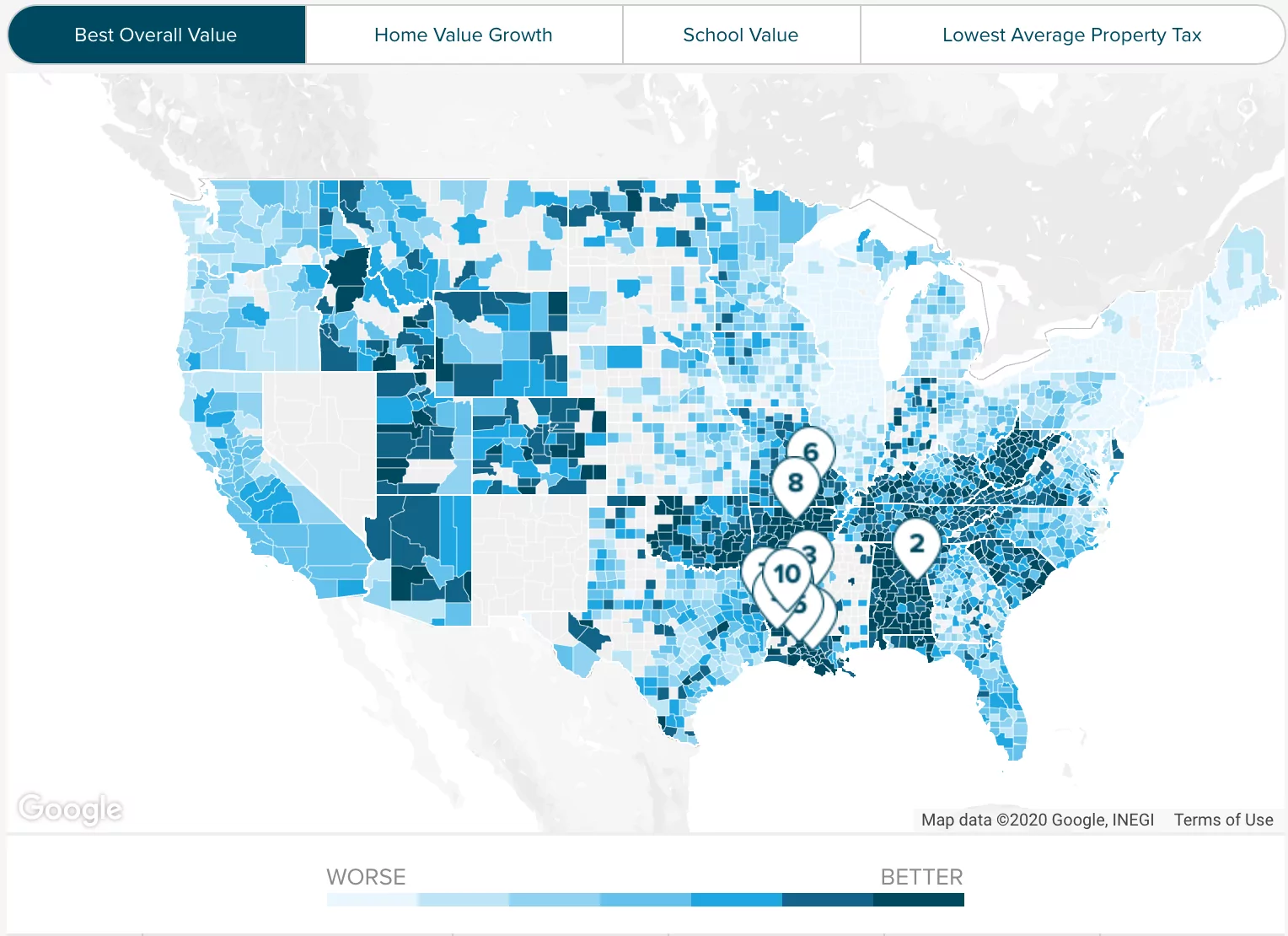

South dakota property taxes by county. The second half of property tax payments will be accepted until october 31st. The county’s average effective property tax rate is 1.36%. South dakota property taxes by county.

Then the property is equalized to 85% for property tax purposes. Questions answered every 9 seconds. Maintain accounting records for hamlin county.

Reporting registration to south dakota division of motor vehicles. • $102,000 x ($10/1,000) = $1,020 • this same computation is performed for each taxing jurisdiction that can tax the property, with the sum of all taxes for each taxing jurisdiction being the total property taxes due on the property. Lincoln county collects the highest property tax in south dakota, levying an average of $2,470.00 (1.46% of median home value) yearly in property taxes, while mellette county has the lowest property tax in the state, collecting an average tax of $510.00 (1.02% of median home value).

You can pay your taxes by mail. For instance, if your home has a full and true value of $250,000, the taxable value will add up to ($250,000 multiplied by 0.85) $212,500. Special assessments, such as road district fees, are due.

The exact property tax levied depends on the county in south dakota the property is located in. Real estate tax notices are mailed to property owners in january. Real estate taxes are paid one year in arrears.

South dakota has 66 counties, with median property taxes ranging from a high of $2,470.00 in lincoln county to a low of $510.00 in mellette county. To qualify the following conditions must be met: No transactions will begin after 4:40 p.m.

If your taxes are delinquent, you will not be able to pay online. This interactive table ranks south dakota's counties by median property tax in dollars, percentage of home value, and percentage of median income. Stanley county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in stanley county, south dakota.

Recording all liens, canceling liens, and duplicate titles. Issue motor vehicle registrations licenses. This eastern south dakota county has the highest property taxes in the state.

This is the value upon which your south dakota property taxes are based. First half property taxes are due by april 30 th; Second half are due by october 31 st.

Assessed values are subject to change by the assessor, board of review or state equalization processes. The county treasurer duties are. Questions answered every 9 seconds.

A major reason for the high tax payments here is that lincoln county also has the highest median home value in the state of $218,400. If you would like to pay your property tax by credit card, we accept discover, visa and mastercard. Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents.

The hutchinson county tax assessor is the local official who is responsible for assessing the taxable value of all properties within hutchinson county, and may establish the amount of tax due on that property based on. All special assessments are due in the full. Please notate id# wishing to pay.

The taxing authorities then apply an 85% equalization ratio to get the property's taxable value. The median annual property taxes paid by homeowners in lincoln county is $2,974. Median property tax is $1,620.00.

(real estate tax payments can be mailed to the minnehaha county treasurer, 415 n dakota ave, sioux falls, sd 57104.) 2. If you are unable to locate the information you need, please contact: Ad a tax advisor will answer you now!

Custer county collected more than $10 million in real estates taxes in 2008. 711 w 1st st, ste 206. (payment drop box is accessible 24/7 outside the west doors of the county administration building located at 415 n dakota ave, sioux falls, sd 57104.) 3.

A home with a full and true value of $230,000 has a taxable value ($230,000 multiplied by.85) of $195,500. Municipal tax levy is $10 per thousand. For more details about the property tax rates in any of south dakota's counties, choose the county from the interactive map or.

These records can include stanley county property tax assessments and assessment challenges, appraisals, and income taxes. Ad a tax advisor will answer you now! Payments can be mailed to pennington county treasurer, po box 6160, rapid city sd 57709.

400 s main, box 250. They are maintained by various government offices in deuel county, south dakota state, and at the federal level. If the county is at 100% of full and true value, then the equalization factor (the number to get to 85% of taxable value) would be.85.

Taxes in south dakota are due and payable on the first of january, however, the first half of property tax payments are accepted until april 30th without penalty. The corson county director of tax equalization may provide property information to the public as is without warranty of any kind, expressed or implied. If taxes are delinquent, please contact the treasurer's office for the correct payoff amount and acceptable forms of payment.

Additionally, statutory exemptions may affect the taxable values. Collects all money belonging to hamlin county.

Oil Boom Texas History History Petroleum Engineering

Dakota County Mn Property Tax Calculator - Smartasset

Property Tax South Dakota Department Of Revenue

South Dakota Property Tax Calculator - Smartasset

Property Tax South Dakota Department Of Revenue

Property Tax South Dakota Department Of Revenue

Tax Information In Tea South Dakota City Of Tea

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

South Dakota Property Tax Calculator - Smartasset

North Dakota Quit Claim Deed Form Quites The Deed North Dakota

Property Tax South Dakota Department Of Revenue

How To Deduct Property Taxes On Irs Tax Forms Irs Tax Forms Mortgage Interest Irs Taxes

How Property Taxes Work In South Dakota State Regional Rapidcityjournalcom

The Most Expensive Homes In Every State Mansions Stone Mansion Mansions Luxury

South Dakota Property Tax Calculator - Smartasset

Love Success Oilfield Oil Rig Oil And Gas

Pin On Lugares Que Visitar

Chart 4 South Dakota Local Tax Burden By County Fy 2015jpg South Dakota Dakota Burden

4 Questions To Ask Before Buying A Home Ryan Serhant Property Tax Buying A New Home Home Buying

Comments

Post a Comment