The current total local sales tax rate in contra costa county, ca is 8.750%. Contra costa supes seek ballot measure the tax would raise an estimated $81 million a year to pay for certain county services.

The Effects Of Metro Fare Increase On Transport Equity New Evidence From Beijing - Sciencedirect

San francisco (kron) — several bay area cities saw a sales & use tax hike go into effect on april 1.

Contra costa sales tax increase. Uninc this quarter* 13% fuel 24% pools 6% restaurants 7% autos/trans. The raise was approved by california voters in the nov. Concord voters will consider measure v, which also would continue and increase an existing sales tax from 0.5% to 1%.

This is the total of state and county sales tax rates. The bill also grants contra costa county an additional authorization for another 1/2% sales tax increase, such as for the contra costa transportation authority, thereby boosting the maximum countywide rate to 9.25%, plus any current city rates. Measure x, which would raise $81 million a year for the next two decades in contra costa county by hiking up the sales tax half a percent, was also approved by voters.

Concord's overall sales and use tax rate will rise from 8.75 percent to 9.25 percent. Method to calculate contra costa county sales tax in 2021. 1 the city increased its existing tax of 0.50 percent (cncd) to 1.00 percent (cntu) in addition to the contra costa countywide increase of 0.50 percent listed in the countywide table.

The california state sales tax rate is currently %. It’s projected to raise $27 million annually. The minimum combined 2021 sales tax rate for contra costa county, california is.

The contra costa county sales tax rate is %. The “current pandemic” is among rationales advanced by the measure’s supporters. If it passes, sales tax would increase by half a percent on most goods, but not on necessities like food and medicine.

California city & county sales & use tax rates (effective october 1, 2021) these rates may be outdated. The average sales tax rate in california is 8.551%. The contra costa county supervisors last month approved spending $10,000 for a poll by the firm fm3 research to help determine voter support for the sales tax measure.

Contra costa county, ca sales tax rate. Contra costa county raised from 8.25% to 8.75% el sobrante , discovery bay , rodeo , crockett , byron , bethel island , diablo , knightsen , port costa and canyon The california sales tax rate is 6.5%, the sales tax rates in cities may differ from 6.5% to 11.375%.

41 rows a “yes” vote supported authorizing an additional sales tax of 0.5% for 20 years. As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate. For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage.

The december 2020 total local. The 2018 united states supreme court decision in south dakota v. Contra costa county collects a 2.25% local sales tax, the maximum local sales tax allowed under california law contra costa county has a higher sales tax than 51.8% of.

Look up the current sales and use tax rate by address

Contra Costa County California Detailed Profile - Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

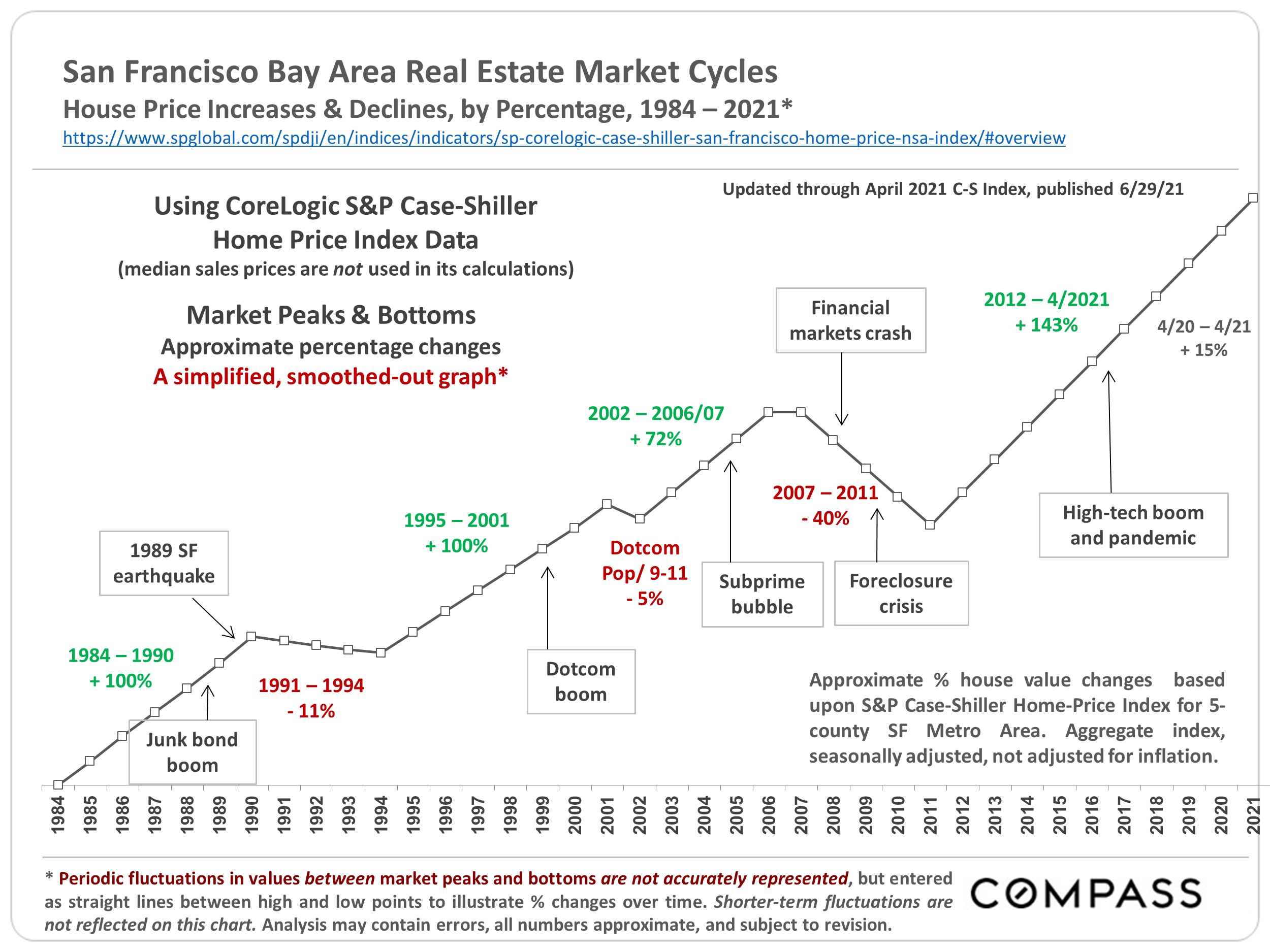

Bay Area Real Estate - Home Prices Trends Factors - Compass

2

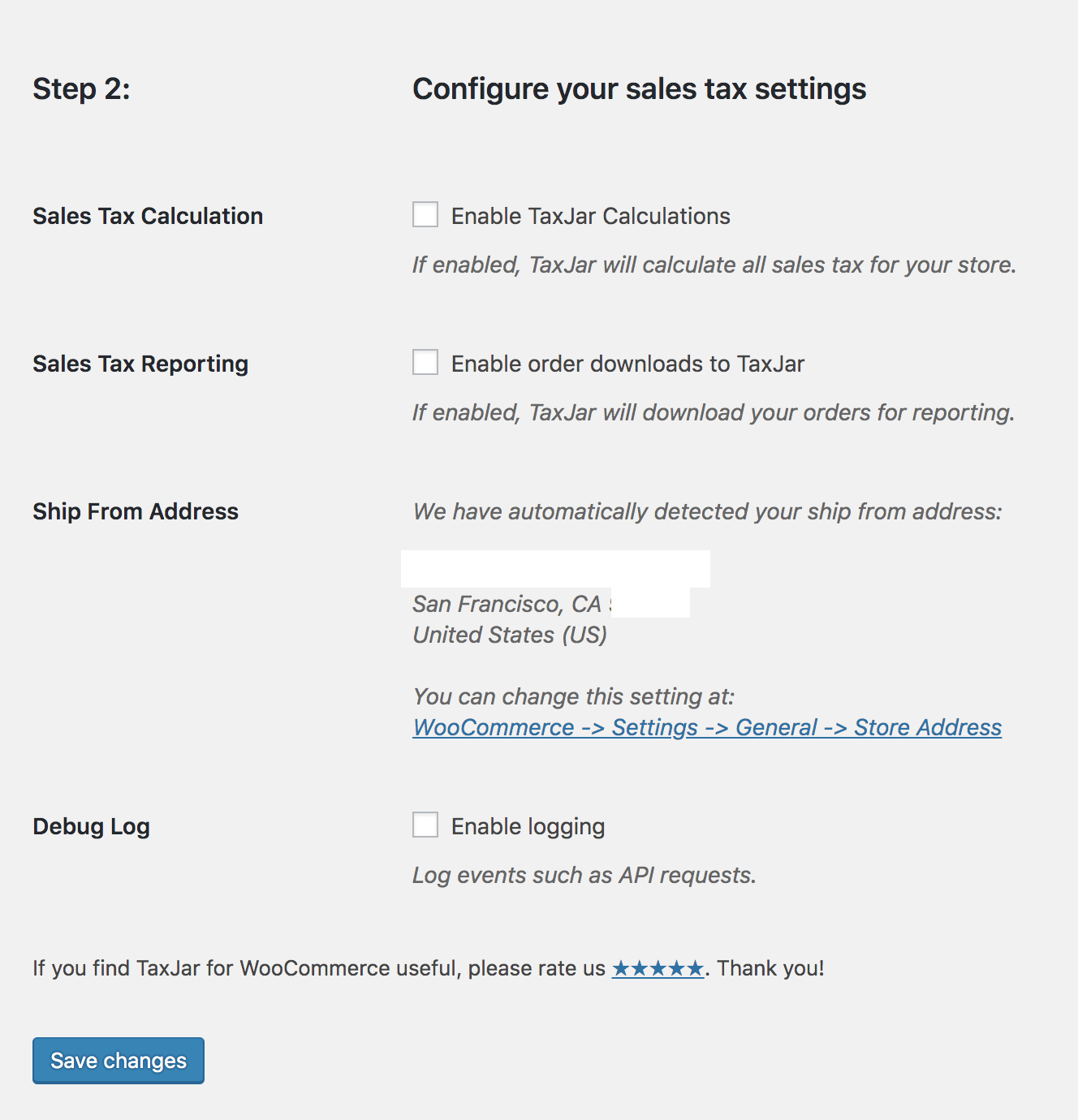

Taxjar For Woocommerce - Woocommerce

Economy In Contra Costa County California

Contra Costa County California Detailed Profile - Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Taxjar For Woocommerce - Woocommerce

Helena 7x7 Real Estate Properties Bay Area Real Estate Markets Survey

Contra Costa County California Detailed Profile - Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

2

![]()

Placer County California Sales Tax For Roads And Transportation Measure M November 2016 - Ballotpedia

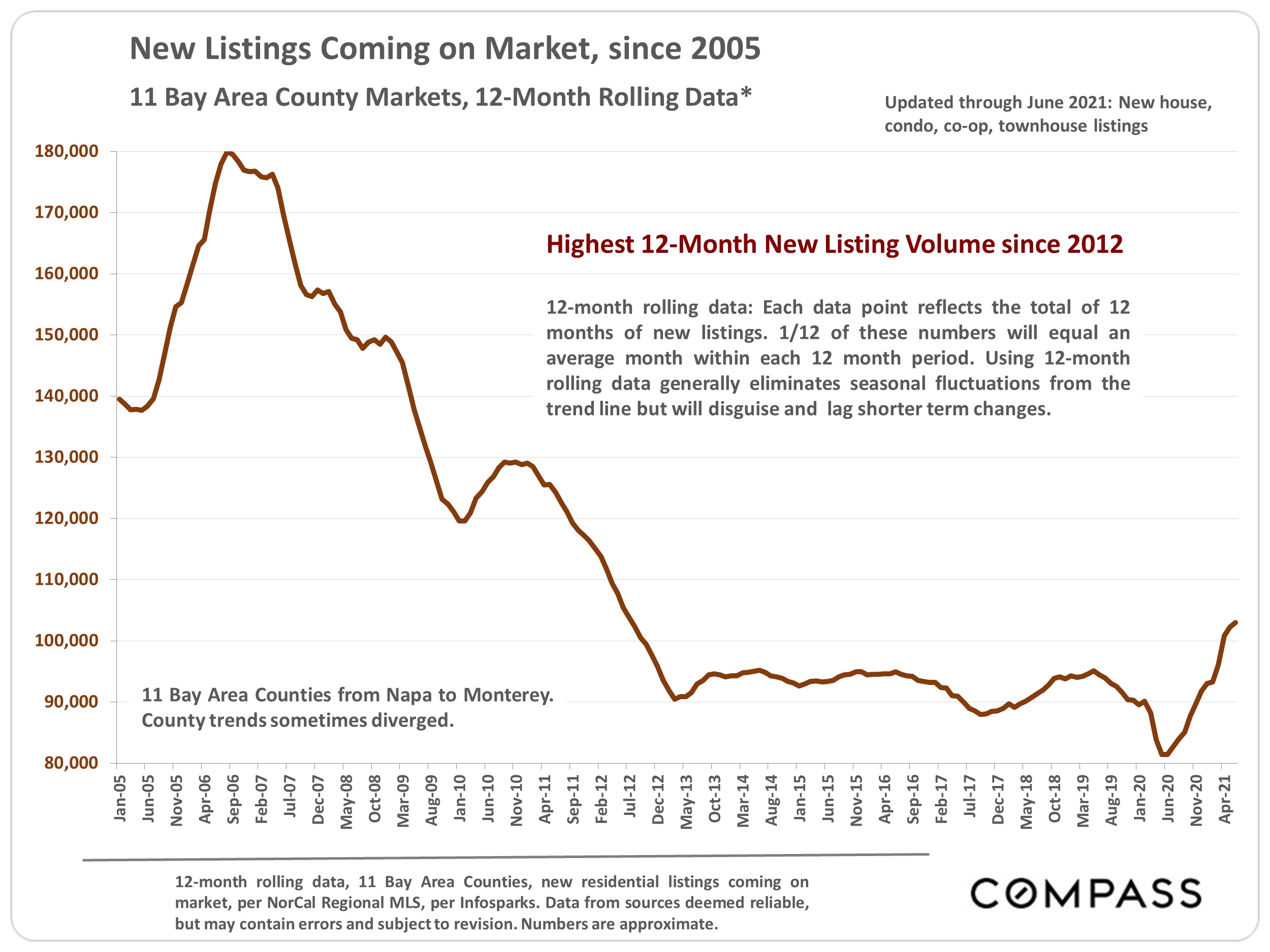

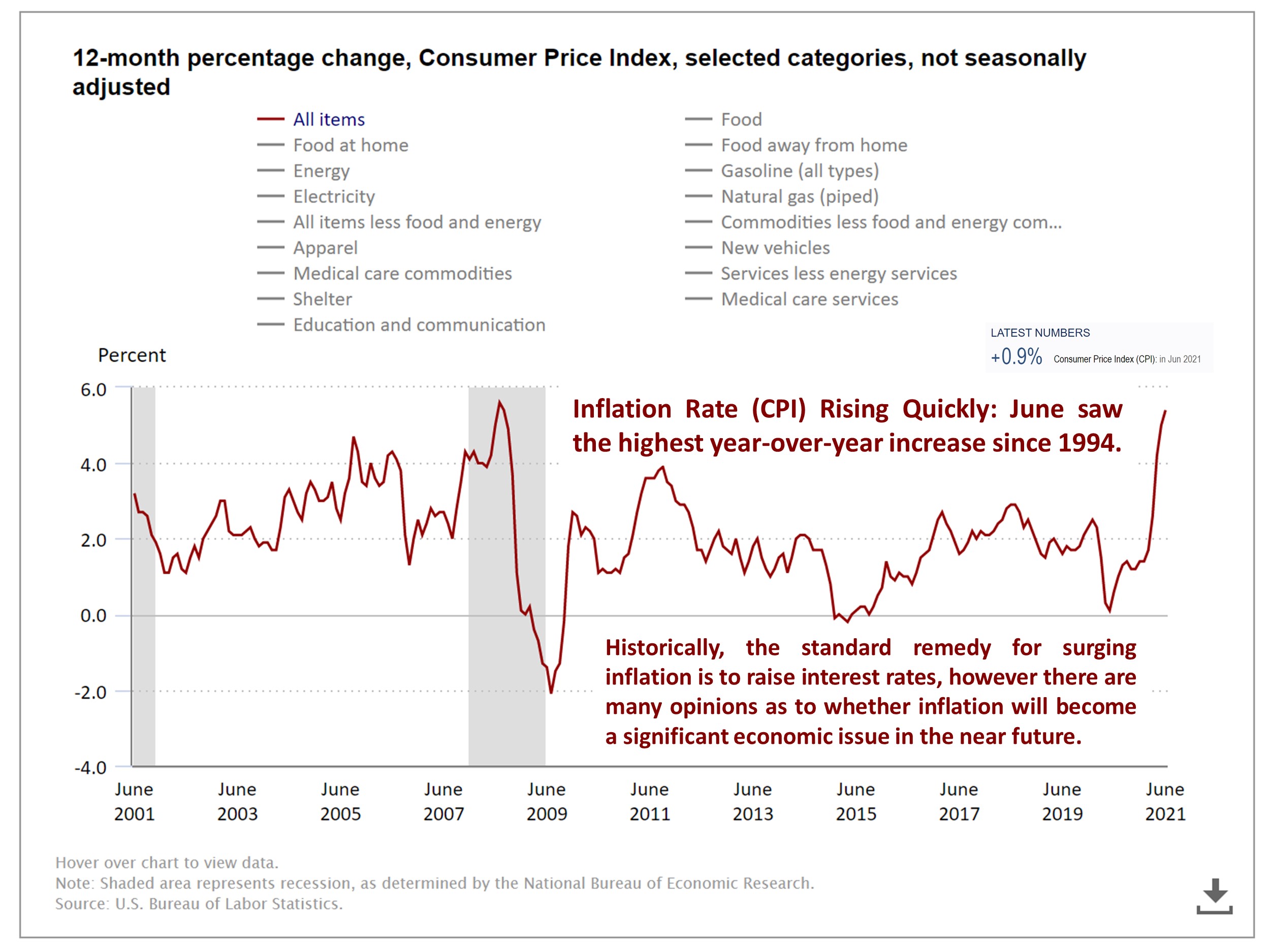

Bay Area Real Estate - Home Prices Trends Factors - Compass

2

New In-migrants Account For Most Of Josephine Countys Population Gains - Article Display Content - Qualityinfo

Contra Costa County California Detailed Profile - Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Bay Area Real Estate - Home Prices Trends Factors - Compass

Placer County California Sales Tax For Roads And Transportation Measure M November 2016 - Ballotpedia

Economy In Contra Costa County California

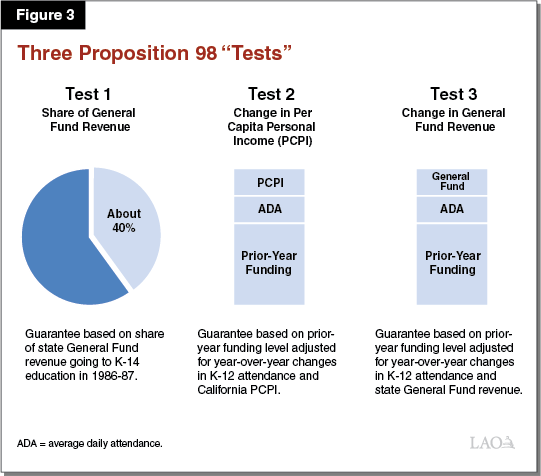

The 2019-20 Budget Proposition 98 Analysis

Comments

Post a Comment