No personal checks or postmarks accepted. Find more information about sold taxes.

States With The Highest And Lowest Property Taxes Property Tax High Low States

Type in your parcel number or your mobile home number in.

When are property taxes due in will county illinois. Counties in illinois collect an average of 1.73% of a property's assesed fair market value as property tax per year. The remaining half of the first installment is due by august 3, 2021. (shutterstock) will county, il — due to the dire financial.

Brophy is encouraging all residents to use one of the alternate methods to pay taxes, rather than come to the office and waiting in often long lines. That office can assist you with the payment options that are available within your county and the due dates and penalties if your property taxes are not paid in a timely manner. In cook county, the first payment was due in early march, according to the cook county.

Half of the first installment is due by june 3, 2021. “collector” = will county or will county mobile home. Will county calculates the property tax due based on the fair market value of the home or property in question, as determined by the will county property tax assessor.

Once on the govtech page, proceed as follows: County boards may adopt an accelerated billing method by resolution or ordinance. Because the due date for the first installment has already passed, any potential changes would apply to the second installment, pappas said.

Welcome to property taxes and fees residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section. “my staff and i are working hard to implement the change in the payment. Illinois has one of the highest average property tax rates in the country, with only six states levying higher property taxes.

Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. Will county real estate tax bills are issued each year in may, with installment due dates typically in june and september. Do property taxes decrease at age 65?

Will county property tax bills mail on may 1, 2019. This early change will help his office send out about 275,000. Will county property taxes due thursday , sept.

Cook county’s property tax calendar is different from the collars. Late penalties increase an additional 1.5% on any unpaid balance on the 5th of each month. Will county treasurer tim brophy said the board should establish june 3, aug.

Market value market value has been defined by the supreme court as the sale price of real estate as agreed upon between a willing buyer and willing seller, with neither being under duress to buy or sell. Will county treasurer tim brophy said the board should establish june 3, aug. The first installment must be paid by june 4, 2019 with the second installment due on september 4, 2019.

The county treasurer or the county collector handles the payment of property taxes within the county. County assessment officers, local boards of review, county collectors). *** mortgage companies and banks must submit one check per pin ***.

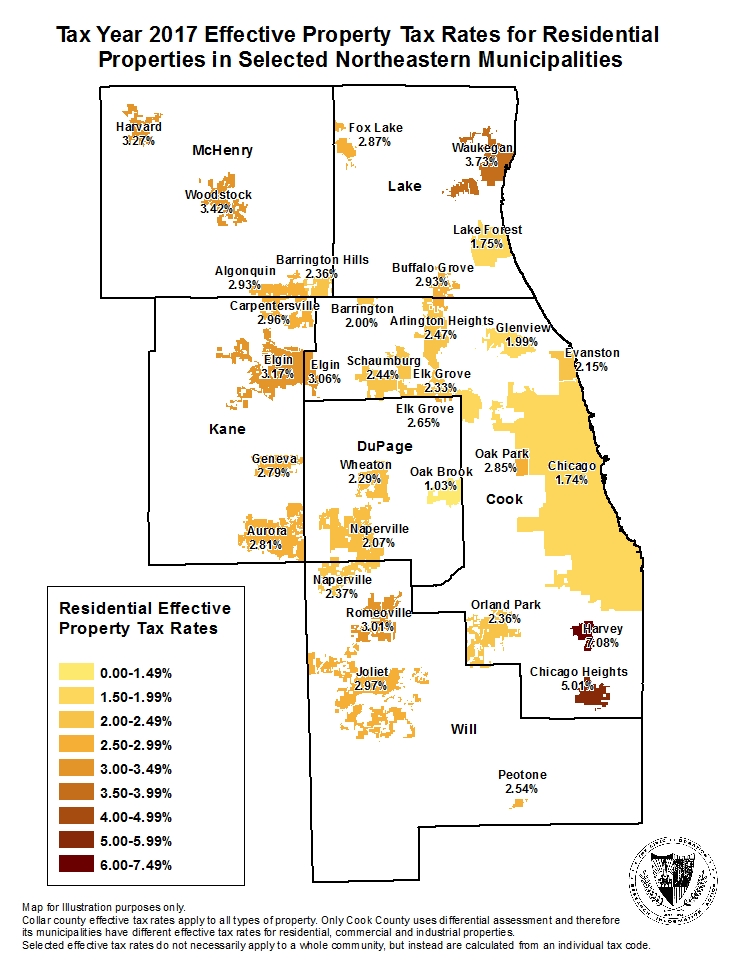

Kane county has some of the highest property taxes in illinois. Inquire real estate tax information. You also may want to contact the county supervisor of assessments.

Where do you pay your taxes? Will county property taxes help? Will county property taxes due date?

You may still use your discover card to pay through our website or in person only, no faxes or emails accepted. Property taxes in illinois are paid in two installments, with 55% of the total bill due in the first payment. The 1st installment of real estate taxes is due on june 4, 2019.

The average effective property tax rate in the county is 2.64%, more than double the national average. Late penalties increase an additional 1.5% on any unpaid balance on the 5th. Property tax in illinois is imposed by local government taxing districts (e.g., school districts, municipalities, counties) and administered by local officials.

The 2nd installment of real estate taxes is due on september 4, 2019. Will county property tax due dates 2021? Effective immediately, discover no longer offers reduced fees for payment of property taxes.

Use the link below to get information about. The will county treasurer facilitates this program for the state of illinois. Clicking on the links with this symbol ( ) will take you to a county office or related office with its own website while the links without the symbol belongs to a department maintaining webpages within the county site itself.

Will county will mail real estate property tax bills on wednesday, may 1, 2019. 3 as the due dates for 2021. Will county treasurer pat mcguire encourages taxpayers to read the ways to pay guide at www.

Late penalties increase an additional 1.5% on any unpaid balance on the 5th of each month. Property taxes in will county are well above both the state and national averages. In most counties, property taxes are paid in two installments, usually june 1 and september 1.

This process is known as the tax sale. Real estate tax bills will be mailed beginning on may 1 and the first installment payment will be due june 3. The next page will be “parcel number search”.

3, 2020 and the second half is due on nov. Property taxes are collected and spent at the local level. The median property tax in illinois is $3,507.00 per year for a home worth the median value of $202,200.00.

Likewise, half of the second property tax bill is due on sept. Illinois does not have a state property tax. If the tax bills are mailed late (after may 1), the first installment is due 30 days after the date on your tax bill.

That means that if you own a $200,000 home in will county, you can expect to pay around $5,280 a year in property taxes. Click on “pay property tax”. The first installment was due in early march and the second is due aug.

There are several convenient ways to pay your real estate property taxes. The second installment of will county property taxes is due thursday , september 2. When illinois became a state in 1818, the illinois constitution allowed the state and local taxing districts to.

Com to help stretch their dollars. These bills are for taxes owed in 2018. 3 as the due dates for 2021.

After december 17, only cashier checks, money orders or cash.

Cook County Property Owner Tax Bill Payments Extended Until October 1st West Suburban Journal

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Dupage County Il Treasurer - Sample Tax Bill

The Cook County Property Tax System Cook County Assessors Office

The Cook County Property Tax System Cook County Assessors Office

Property Tax - City Of Decatur Il

Pin By Bobbie Persky Realtor On Finance - Real Estate Property Tax Tax Attorney Tax Lawyer

Property Tax Village Of Carol Stream Il

Illinois Property Taxes Danger Danger Property Tax Real Estate Infographic Real Estate Articles

Property Tax Prorations - Case Escrow

Gorgeous High-end Home In Mokena Il On 3 Acres Zoned For 2 Horses In Will County Whole House Generators Custom Walk In Closets Professional Landscaping

Cook County Property Tax Bill How To Read Kensington Chicago

Estimated Effective Property Tax Rates 2008-2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Increasing Property Taxes Impact Land Owner Returns And Equilibrium Land Values Farmdoc Daily

Reboot Illinois - Which Illinois Counties Have The Highest Average Home Prices And Property Taxes Property Tax Dupage County County

What Is The Right Tax Proration Amount In Chicago Closings - Chicago Real Estate Closing Blog

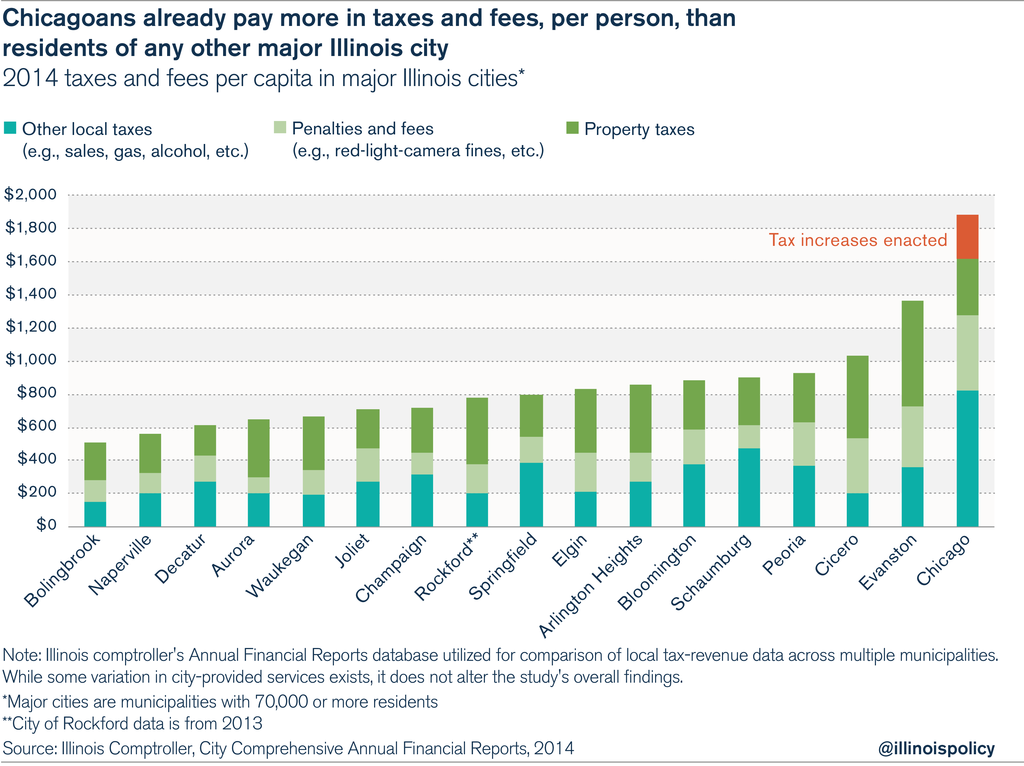

The Chicago Squeeze Property Taxes Fees And Over 30 Individual Taxes Crush City Residents

Ten-year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Exemptions

Comments

Post a Comment