House democrats on friday passed their $1.75 trillion spending package with a temporary increase for the limit on the federal deduction for state and local taxes, known as salt. November 5, 2021 at 1:29 p.m.

The Retired Investor Will Salt Be Repealed Iberkshirescom - The Berkshires Online Guide To Events News And Berkshire County Community Information

The franchise tax board estimated in 2018 that the salt deduction limit cost californians an additional $12 billion a year in federal taxes.

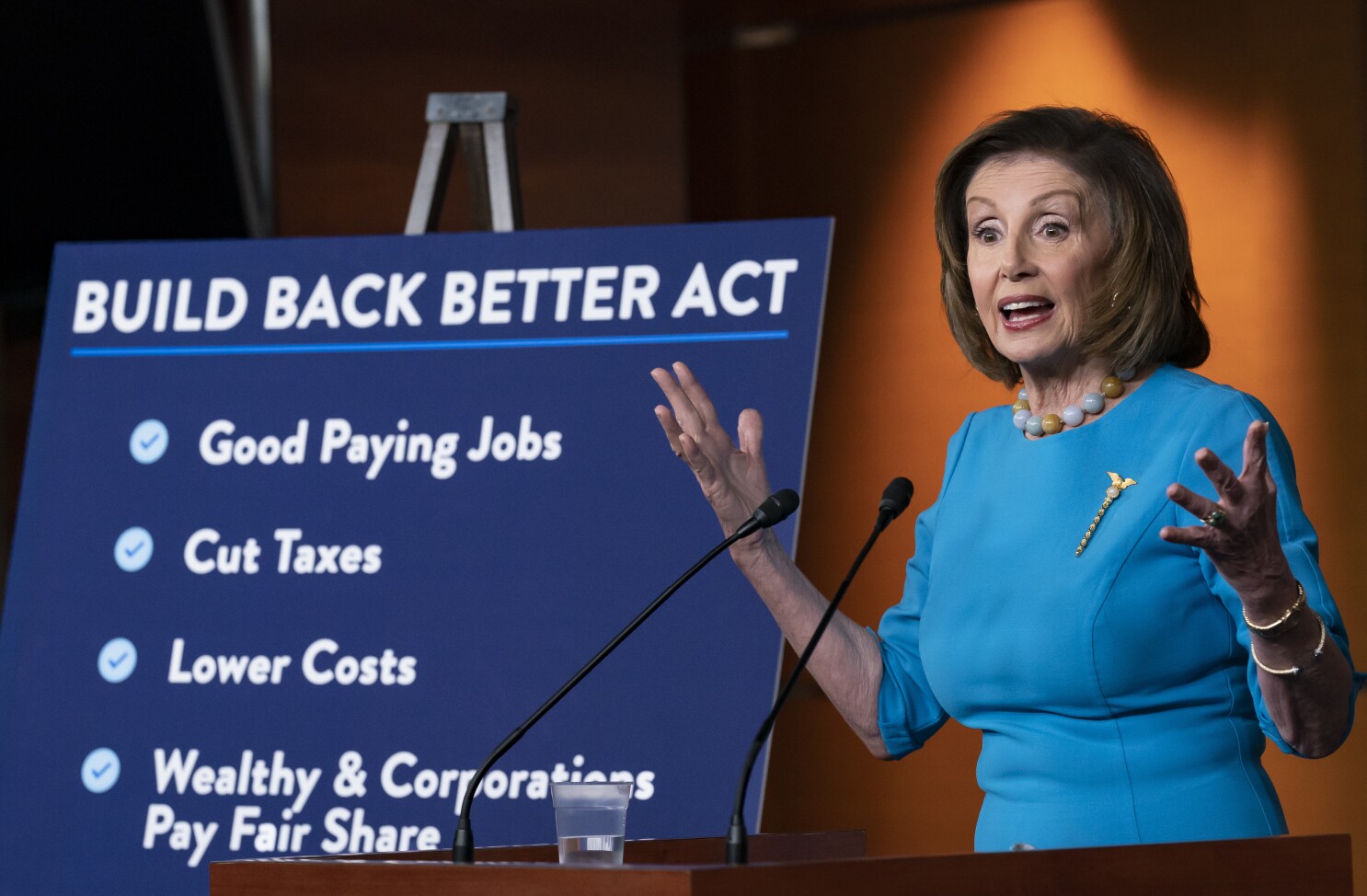

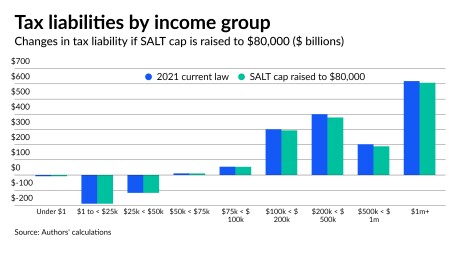

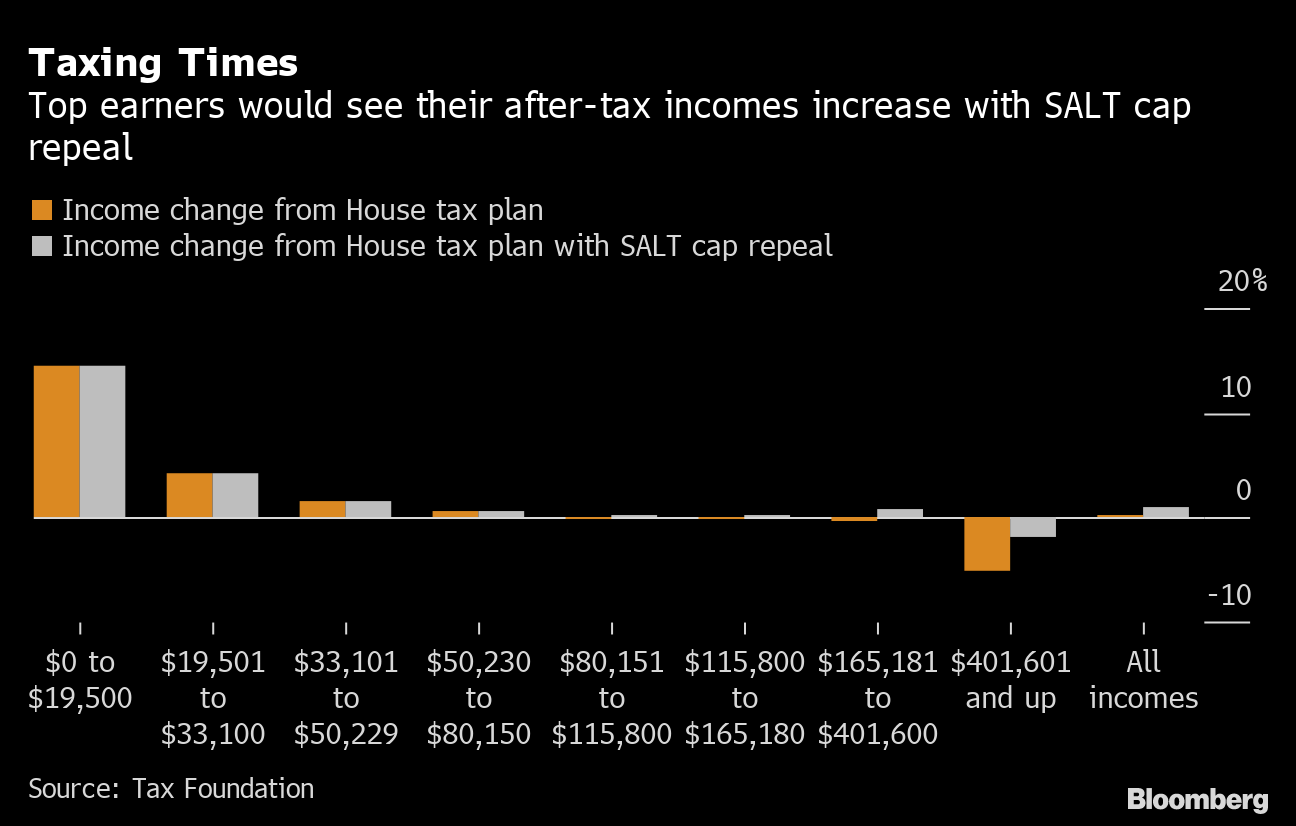

Salt tax repeal march 2021. But for many democrats from high property tax states like new york, repealing or altering the federal cap on deductions for state and local taxes (salt) is just as big a priority. According to the nonpartisan tax policy center, the top 20% of taxpayers may receive more than 96% of the benefit of a salt cap repeal and the top 1% would see about 54% of the benefit. House speaker nancy pelosi is fighting to repeal the cap.

That’s because only about 10 percent of all tax filers itemize their deductions. If line 5e of your 2020 schedule a shows $10,000 even, you ran up against the salt cap. Earlier this week, the house appeared ready to fully repeal the salt cap, cutting taxes for the top 0.1 percent by an average of $150,000 per year.

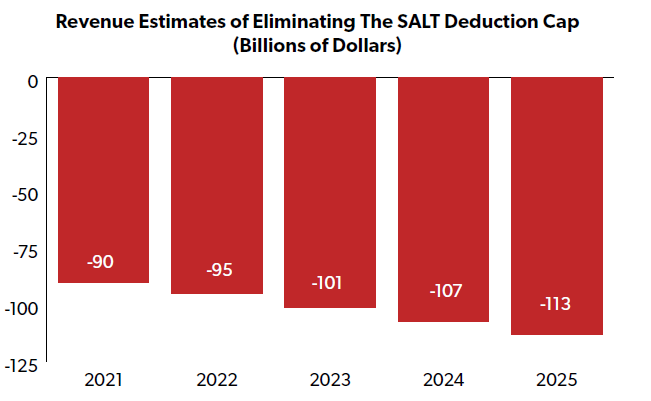

The plan reportedly would repeal the salt cap for 2022 and 2023 only. The state franchise tax board reported that in 2018, the salt cap cost californians $12 billion. Raising the salt cap to $80,000 would reduce federal income tax liability by $55.9 billion in 2021, making it $35.3 billion less expensive than full cap repeal.

According to press reports, the senate is considering repealing the $10,000 cap on the state and local tax (salt) deduction for those making $500,000 per year or less. The existing $10,000 limit on salt is scheduled to expire at the end of 2025, along with many of the other individual tax changes from trump’s 2017 tax law. Repealing the salt cap in 2021 would reduce federal income tax liability by approximately $91 billion, or 7.2 percent.

This would be in place of the house plan to lift the cap to $80,000 through 2030 and reinstate it. The salt limit deduction brought in $77.4 billion during its first year, according to the joint committee on taxation, and a full repeal for 2021 may cost up to $88.7 billion, and more going forward. In fact, the repeal of the cap would lower the taxes of new yorkers by upwards of $12 billion a year.

Bernie sanders is trying to stop them. Nov 19, 2021 | taxes. I stand by my call that i will not support any change in the tax code unless there is a restoration of the salt deduction.

Bernie sanders holds a news conference about state and local tax (salt) deductions as part of the build back better reconciliation legislation at the us capitol on november 3, 2021, in washington, dc. House democrats have proposed to raise the $10,000 cap on state and local tax (salt) deductions to $80,000 and extend that higher limit through. The democrats are poised to pass a giant, regressive tax giveaway to the wealthy by raising the salt cap deduction.

November 16, 2021, 1:13 pm est updated on november 16, 2021, 1:46 pm est sanders said wealthiest could maintain $10,000 deduction menendez. One would allow unlimited state and local tax deductions for people earning up to $400,000 with a. Various proposals are under discussion in congress this week to repeal the salt cap.

The senate approach would likely replace the salt measure in the house version of the bill that calls for lifting the cap to $80,000 from $10,000. Biden did not propose a repeal of the $10,000 salt deduction cap, which limits the amount of state and local taxes that can be deducted before paying federal taxes, as part of his social spending. The $10,000 cap would, in theory, resume in 2024 and 2025.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22438807/SALT_Benefits_CBPP.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction - Vox

Sanders Rips Pelosi Schumer For Backing Repeal Of Salt Cap

Dems Want To Repeal Salt Cap So They Can Hike State Taxes

Calls To End Salt Deduction Cap Threaten Passage Of Bidens Tax Plan

Whats The Deal With The State And Local Tax Deduction - Publications - National Taxpayers Union

O5ay_hcl6dyi8m

Liberal Democrats Push To Repeal Salt Tax Cap Will Only Benefit Wealthy - Washington Times

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

Salt Deduction Bond Buyer

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction - Vox

Democrats Pressure Biden To Repeal Salt Deduction Cap

/cdn.vox-cdn.com/uploads/chorus_asset/file/22439062/1256311254.jpg)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction - Vox

Marc Elrich Says Not So Fast On Salt Tax Cap Repeal

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

Salt Break Would Erase Most Of Houses Tax Hikes For Top 1 - Bloomberg

1 Friendly Salt Cap Repeal Is Part Of The Discussion On Bidens 22t Spending Bill Psaki Says Fox Business

Salt-cap Foes Threaten Biden Tax Plan As Repeal Bid Gains Steam - Bloomberg

Salt Deduction Disliked On Both Sides May Live Another Day As Congress Debates 175 Trillion Social-spending Bill - Marketwatch

Making Salt Relief Pay For Itself Among Democrats Options - Roll Call

Comments

Post a Comment