Who must file for estate taxes in nevada? Technically the sales tax rate is between 8.375% and 8.75%.

Taxes In Nevada Us - Legal It Group

A important recent legislative amendment:

Nevada estate tax rate. So even though nevada does not have an estate tax, gift tax, or inheritance tax, it does not mean that she won’t have a problem at the federal level. The nevada income tax has one tax bracket, with a maximum marginal income tax of 0.00% as of 2021. The state of nevada sales tax rate is 4.6%, added to the clark county rate of 3.775% equals 8.375%, but the city charges more.

31 rows the state sales tax rate in nevada is 6.850%. Beginning on january 1, 2018, the bea was increased from $5 million to $10 million as adjusted for inflation. No estate tax or inheritance tax new hampshire:

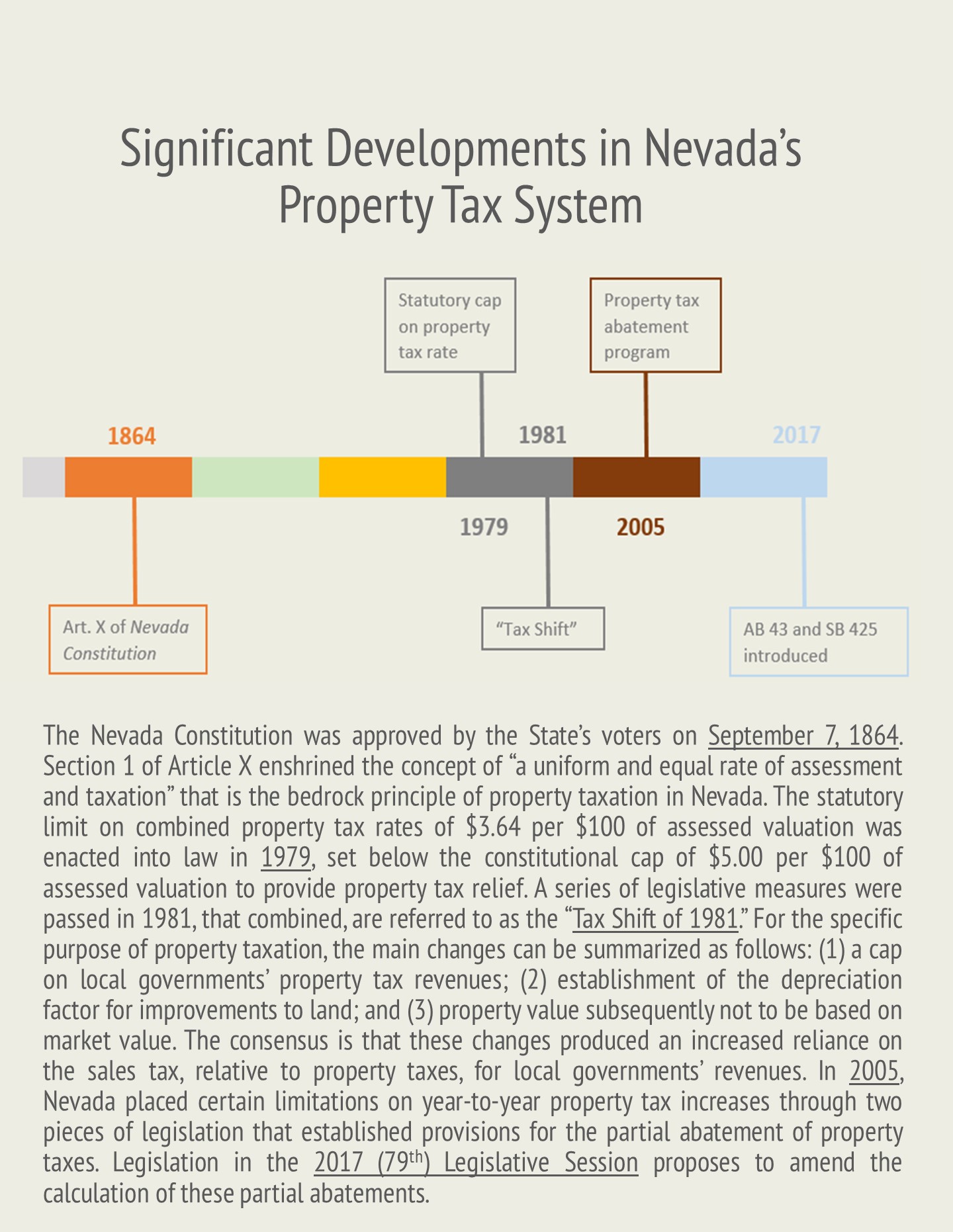

Sales tax in las vegas is higher. If an existing home has already qualified for a 3% or 8% tax abatement, taxes will be calculated on the assessed value or apply the appropriate tax cap percentage to the tax amount paid in the previous year; For example, a home with an assessed value of $200,000 would pay taxes of $1,421.60 per year.

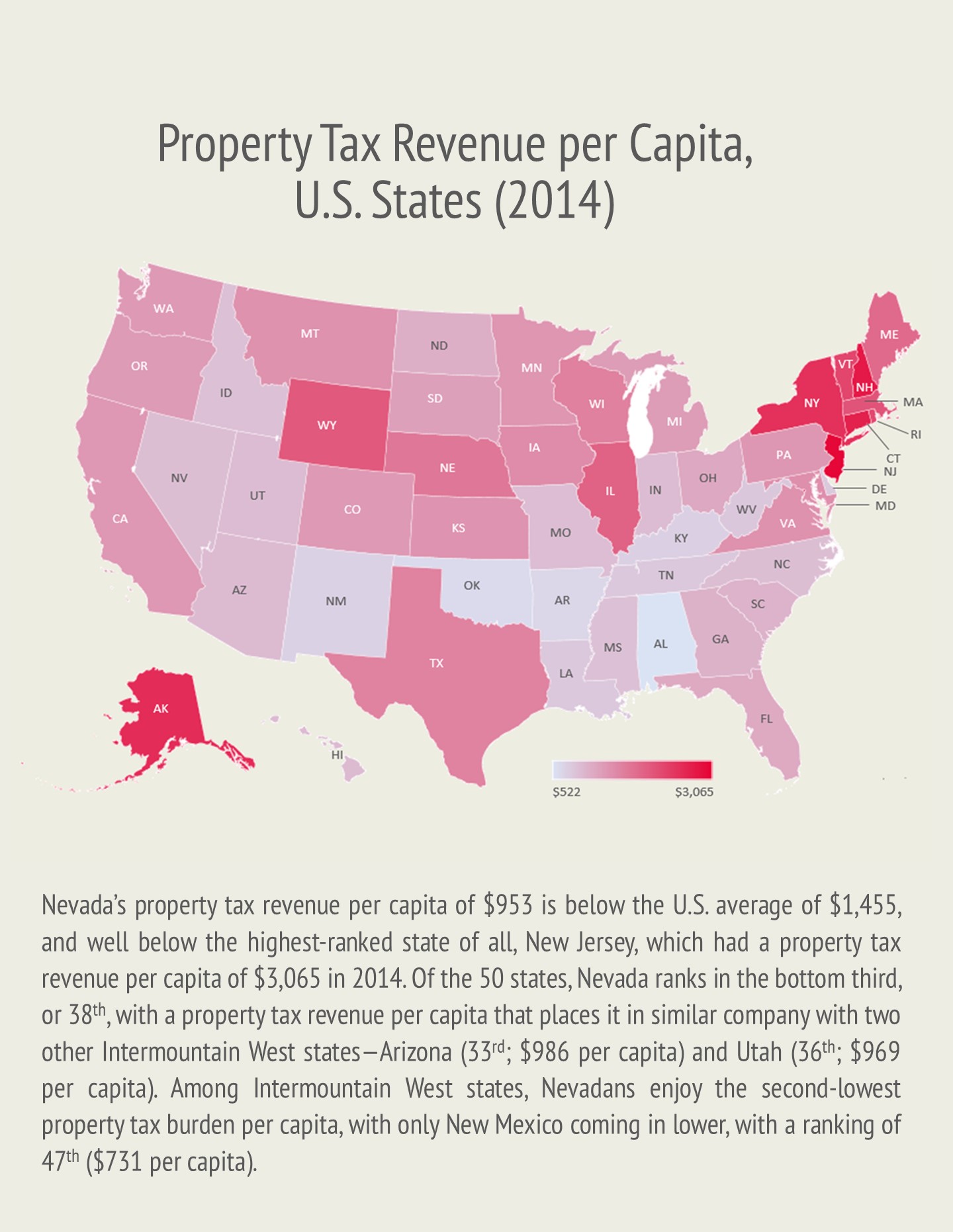

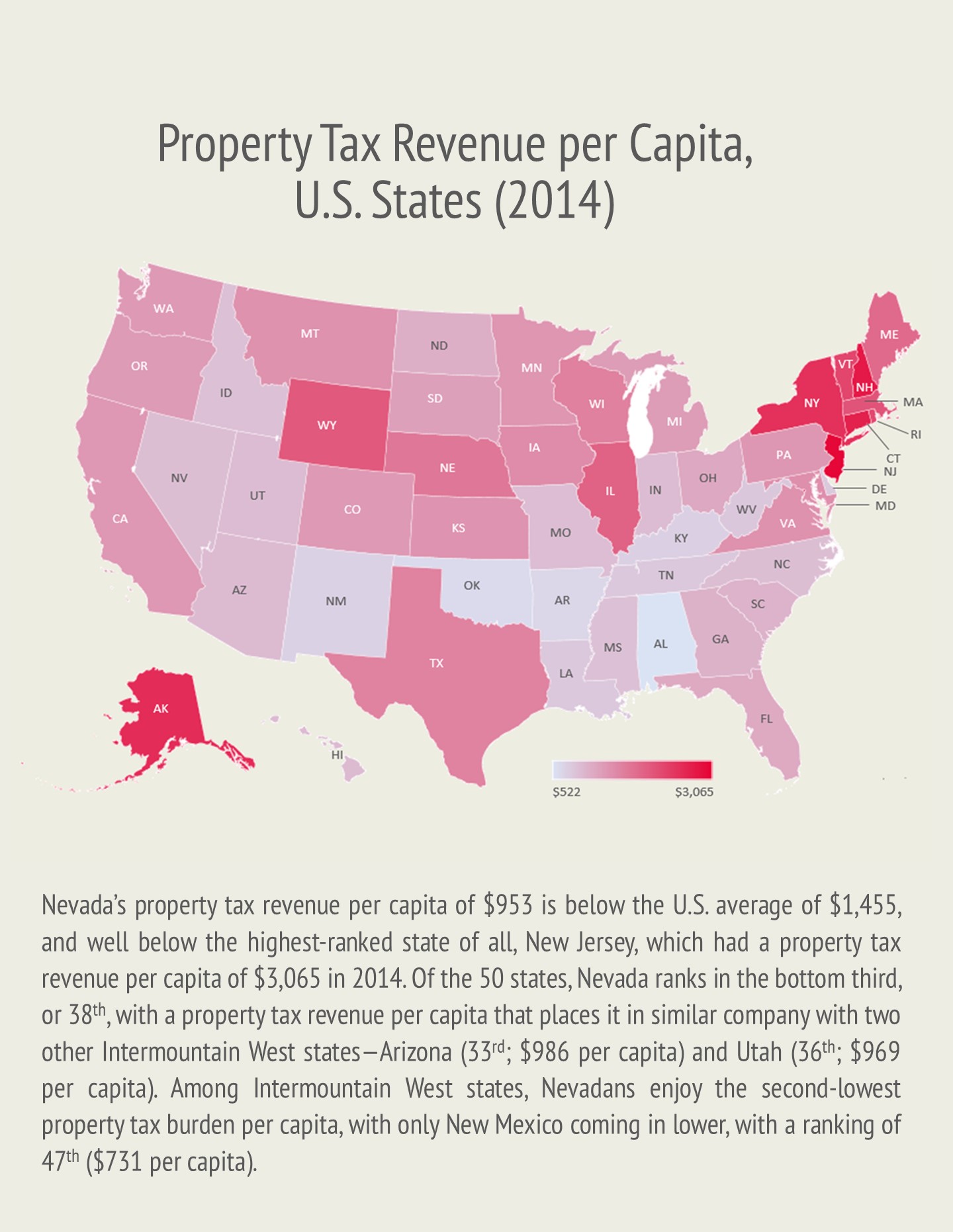

No estate tax or inheritance tax new jersey: Nrs 375a, tax is imposed in the amount of the maximum credit allowable against the federal estate tax for the payment of state death taxes. Houses (9 days ago) the median property tax in nevada is $1,749.00 per year, based on a median home value of $207,600.00 and a median effective property tax rate of 0.84%.

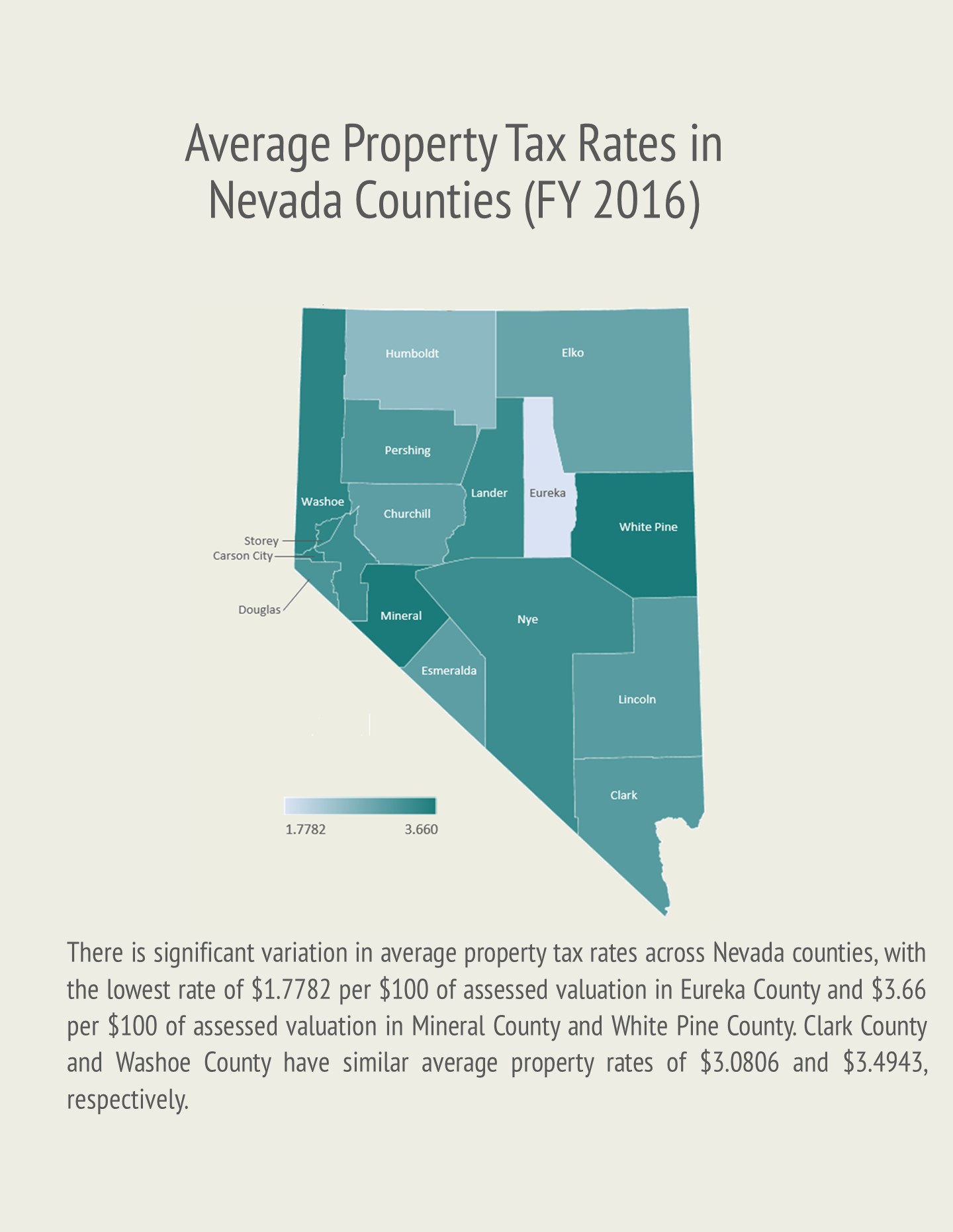

The median property tax in nevada is $1,749.00 per year, based on a median home value of $207,600.00 and a median effective property tax rate of 0.84%. The total overlapping tax rate (subject to approval by the nevada tax commission) for the city of reno is $3.660615 per $100 of assessed valuation. Nevada filing is required in accordance with nevada law nrs 375.a for any decedent who has property located in nevada at the time of death, december 31, 2004 or prior, and whose estate value meets or exceeds the level.

Nevada property taxes vary by county, but the effective state property tax is 0.921 percent. Fortunately, henderson property taxes have one of the lowest rates in the state of nevada; $200,000 x.35 = $70,000 assessed value.

Explore data on nevada's income tax, sales tax, gas tax, property tax, and business taxes. The top inheritance tax rate is 16 percent ( no exemption threshold ) But nevada does have a relatively high sales tax a state rate is around 7% but goes to approximately 8% when you consider local tax rates.

Both nevada's tax brackets and the associated tax rates have not been changed since at least 2001. Tax amount varies by county. To determine the assessed value, multiply the taxable value of the home ($200,000) by the assessment ratio (35%):

Counties in nevada collect an average of 0.84% of a property's assesed fair market value as property tax per year. With local taxes, the total sales. The sales tax in las vegas varies according to the business’ location.

Our rule of thumb for las vegas sales tax is 8.75%. Houses (8 days ago) nevada property tax rates. Nevada is income tax free — nevada is one of seven states with no personal income tax.

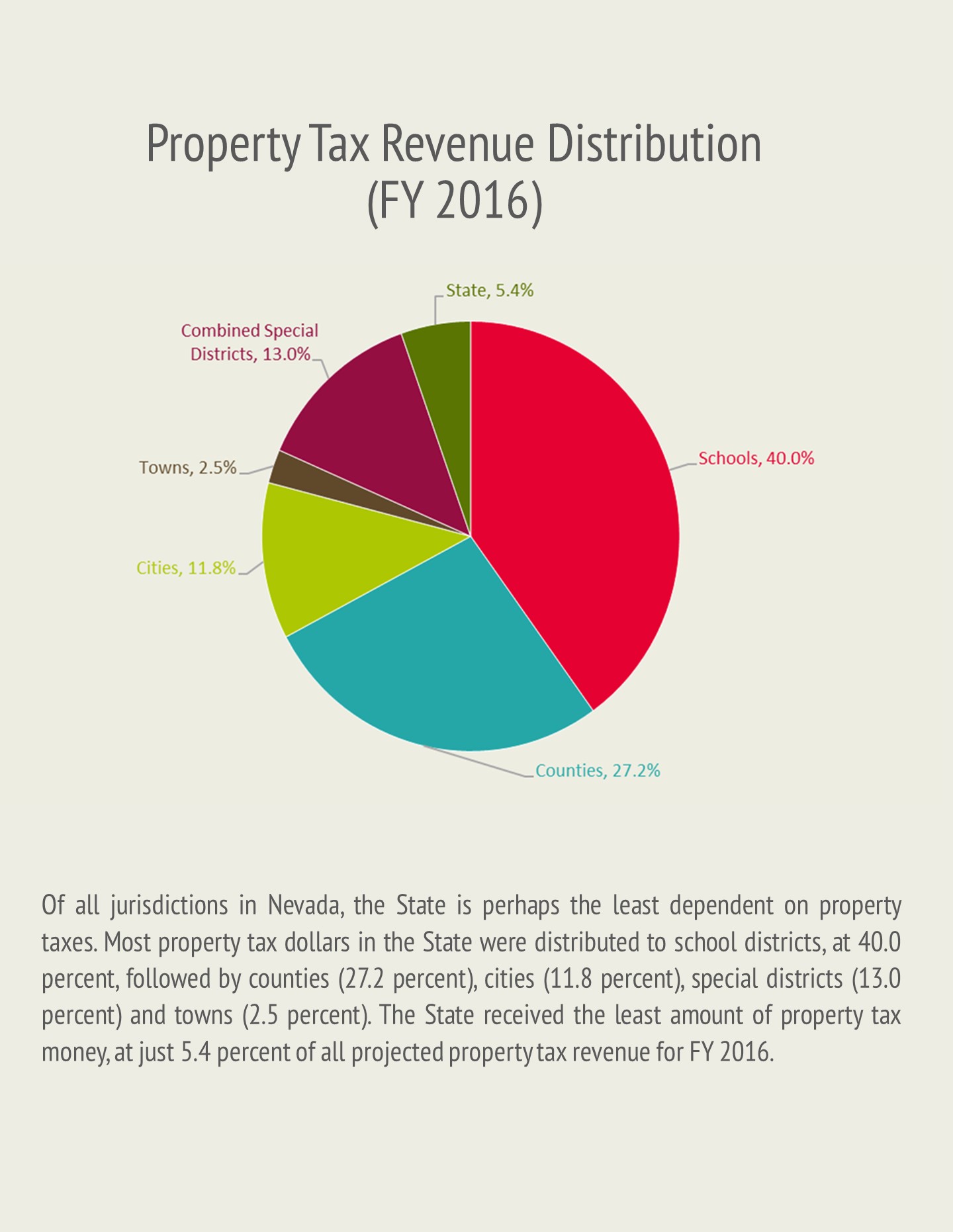

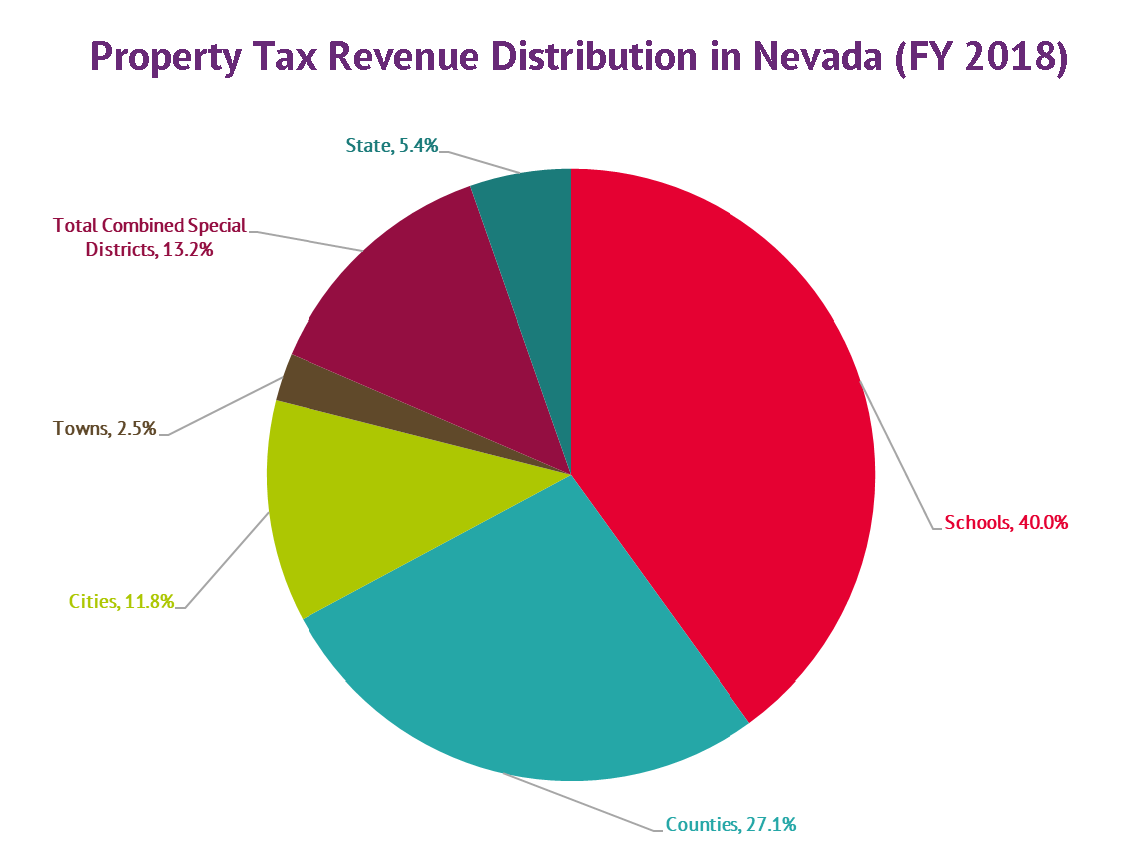

You can look up your recent appraisal by filling out the form below. Local property tax in nevada The federal estate tax exemption is $11.18 million for 2018.

70,000 (assessed value) x.032782 (tax rate per hundred dollars) = $2,294.74 for the fiscal year. It will increase to $11.40 million in 2019. To calculate the tax on a new home that does not qualify for the tax abatement, let's assume you have a home in las vegas with a taxable value of $200,000 located in the as vegas with a tax rate of $3.50 per hundred dollars of assessed value.

Detailed nevada state income tax rates and brackets are available on this page. Nevada real estate tax rate best deals for 2021. Under the current federal tax code, on january 1, 2026, the bea—which is now $11.58 million—will revert or “sunset” back to $5 million as adjusted for inflation.

Here’s a look at the property tax rate by county: Therefore, a home which has a replacement value of $100,000 will have an assessed value of $35,000 ($100,000 x 35%) and the home owner will pay approximately $1,281 in property taxes ($35,000 x 3. The median property tax in nevada is $1,749.00 per year for a home worth the median value of $207,600.00.

Nevada does not have an estate tax, but the federal government has an estate tax that may apply if your estate has sufficient value. Since 1992 it has remained at $0.7108 per $100 of assessed value. To calculate the tax, multiply the assessed value by the applicable tax rate:

Elements and applications property tax rates for nevada local governments (redbook) nrs 361.0445 also requires the department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. Learn about nevada tax rates, rankings and more.

City Of Reno Property Tax City Of Reno

Top Income Tax Rate By State - States With No Income Tax 1alaska 2florida 3nevada 4south Dakota 5 Retirement Income Best Places To Retire Retirement

Property Taxes In Nevada - Guinn Center For Policy Priorities

Kiplinger Tax Map Retirement Tax Income Tax

Which Us States Tweet The Most About Tesla Data Dataviz Gluuio Tesla Infographic Piktochart Us States Texas Usa Data

10 Most Tax-friendly States For Retirees Retirement Locations Retirement Advice Retirement Planning

Podrobnaya Karta Dorog Las-vegasa I Okrestnostey Las Vegas Map Las Vegas Las Vegas Nevada

Taxes In Nevada Us - Legal It Group

Property Taxes In Nevada - Guinn Center For Policy Priorities

Taxes In Nevada Us - Legal It Group

State-by-state Guide To Taxes On Retirees Retirement Advice Retirement Tax

Property Taxes K-12 Financing In Nevada - Guinn Center For Policy Priorities

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Arizona Real Estate

Property Taxes In Nevada - Guinn Center For Policy Priorities

Pin On Lugares Que Visitar

Pin On Real Estate

Property Taxes In Nevada - Guinn Center For Policy Priorities

Taxpayer Information Henderson Nv

Nevada Vs California Taxes Explained - Retire Better Now

Comments

Post a Comment