Tax rates for meals, lodging, and alcohol: Questions answered every 9 seconds.

2

You acquire a use tax obligation when buying goods on the internet, over the telephone, by mail order, or from a business that did not collect the vt sales and use tax, or when buying in states or countries that do not have or do not appropriately collect the sales tax.

Vermont sales tax food. Learn more about vermont sales and use tax. Upon processing of the application, you will be assigned your vermont business tax account number and provided any applicable license(s). The maximum local tax rate allowed by.

One of the amendments crafted by their ways and means committee directed vermont’s 6 percent sales tax to be applied to the sale of dietary supplements. A state employer tax id is only required for employers. Prepared food is subject to special sales tax rates under vermont law.

In most states, necessities such as groceries, clothes, and drugs are exempted from the sales tax or charged at a lower sales tax rate. Ad a tax advisor will answer you now! And the item was used in vermont, you owe use tax to vermont.

Questions answered every 9 seconds. We include these in their state sales tax. Food and beverage supplied by a restaurant;

There are a total of 207 local tax jurisdictions across the state, collecting an. 9.0% on sales of lodging and meeting rooms in hotels; Previously, the second highest quarter for the rooms and meals tax came from july to september 2019, when the town took in $125,211.

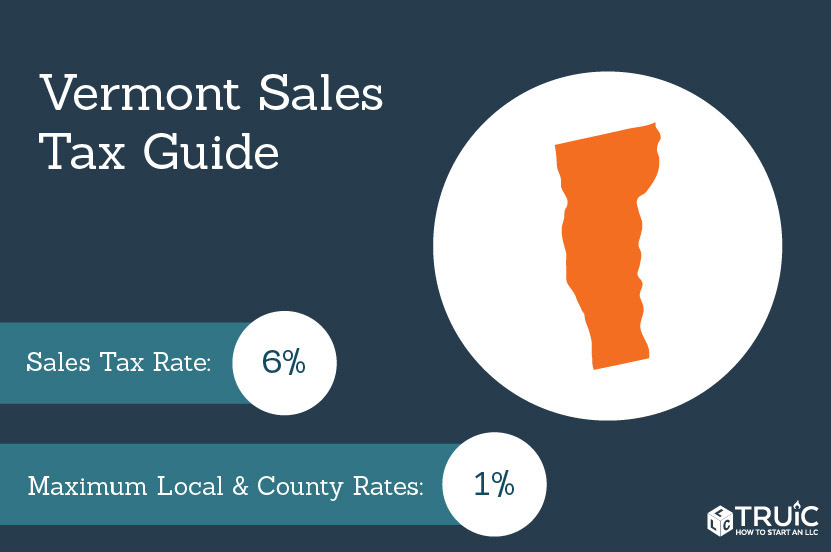

Soft drinks subject to the vermont meals and rooms tax. 9.0% on sales of prepared and restaurant meals; Vermont has a statewide sales tax rate of 6%, which has been in place since 1969.

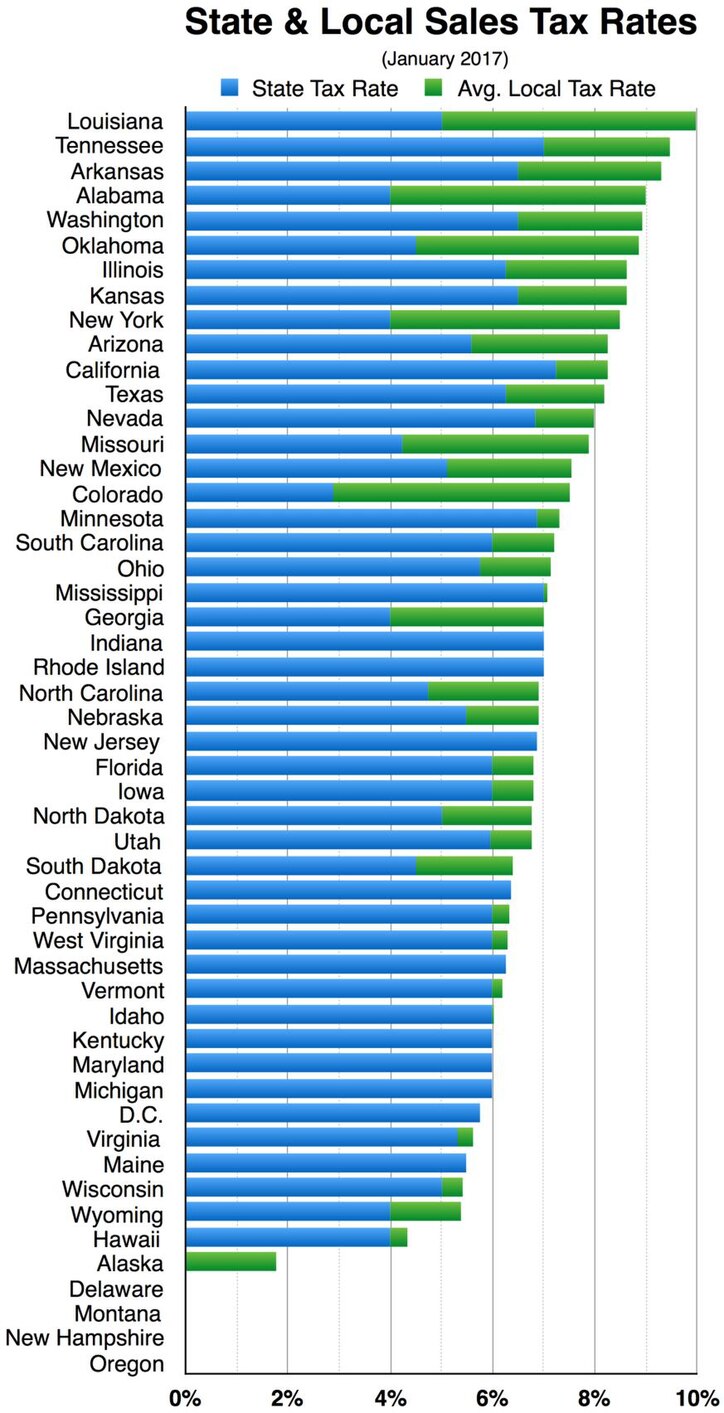

California (1%), utah (1.25%), and virginia (1%). Vermont has state sales tax of 6% , and allows local governments to collect a local option sales tax of up to 1%. Attorney general derek schmidt, a republican who's running for governor, has also called for the legislature to eliminate or significantly reduce food taxes during the 2022 session.

10.0% on sales of alcoholic beverages served in restaurants; A sales tax of 6% is imposed on the retail sales of tangible personal property (tpp) unless exempted by vermont law. Elwell told the reformer that the rooms and meals tax went into effect in brattleboro in 2007, and the highest quarter ever for the revenue source for the town was in july to september 2018, when it received $130,557.

Average sales tax (with local): Certain municipalities may also impose a local option tax on meals and rooms. Hotel and meeting room rentals are subject to a 9% rooms tax, and a 9% meals tax is charged on sales of prepared food and restaurant meals.

A sales state tax id, which is used to buy or sell wholesale and sell retail and also called a seller license wholesale id etc. Previously, supplements — like food — were exempt from the state’s sales tax. In the state of vermont, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer.

The use tax is the same rate as the. 2021 list of vermont local sales tax rates. A business tax registration tax id, wh.

In the state of vermont, they are exempt from any sales tax but are considered to be subject to the meals and rooms tax. Ad a tax advisor will answer you now! Lowest sales tax (6%) highest sales tax (7%) vermont sales tax:

Beer, wine, and liquor sold for immediate consumption are subject to a 10% alcoholic beverages tax. Soda or other beverages by the glass/cup Here are examples of food items subject to vermont meals and rooms tax:

French fries, onion rings, fried dough; Candied apples and cotton candy; Vermont has a 6% general sales tax.

Sales tax treatment of groceries, candy & soda, as of july january 1, 2019 (a) alaska, delaware, montana, new hampshire, and oregon do not levy taxes on groceries, candy, or soda. Sellers should collect vermont sales tax on tpp delivered to destinations in vermont at the time and place. Use tax has the same rate, rules, and exemptions as sales tax.

It should be noted that any mandatory gratuities of up to 15% and all voluntary gratuities that are distributed to employees are not considered to be taxable. Unless you employ workers, you do not need a state ein. Soft drinks sold in vending machines and as part of a taxable meal, such as when bundled with a sandwich and chips, are subject to the vermont meals and rooms tax, not the sales tax.

An example of items that are exempt from vermont sales tax are items specifically purchased for resale. Ice cream cones, slushie cones, or sundaes;

Sales Tax On Grocery Items - Taxjar

What Transactions Are Subject To The Sales Tax In Vermont

The Most And Least Tax-friendly Us States

Vermont Sales Tax - Small Business Guide Truic

Tell States To End The Tampon Tax Tampon Tax Tampons Tax

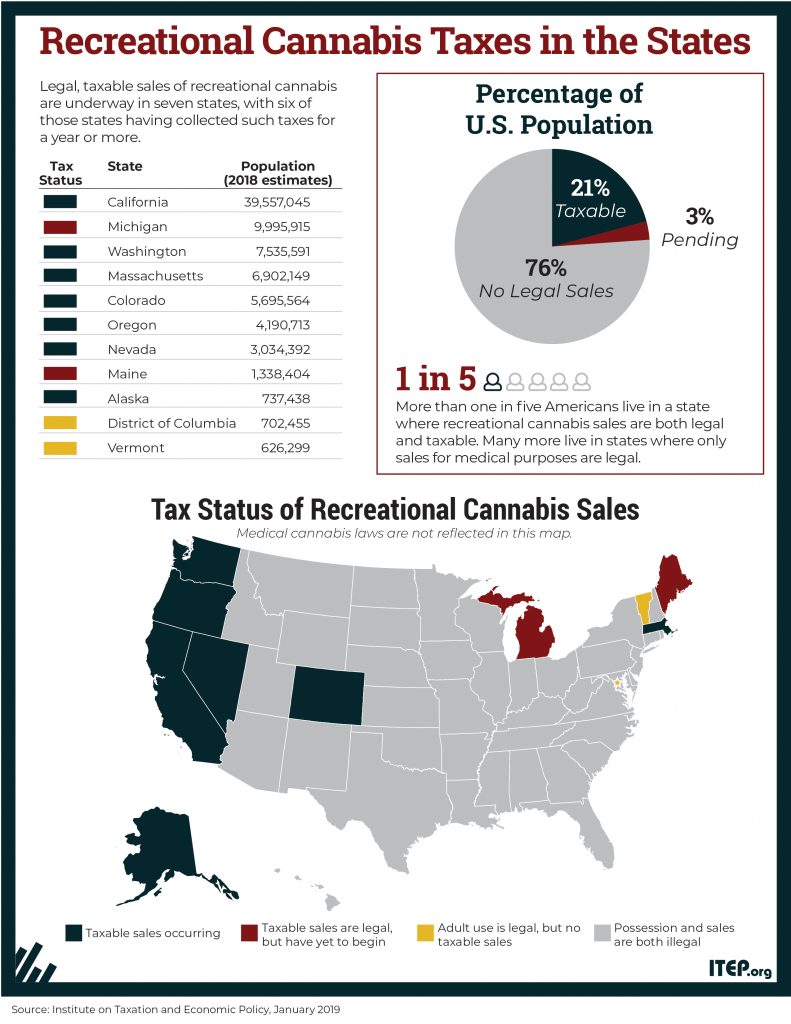

Taxing Cannabis Itep

Sales Tax By State Economic Nexus Laws Nexus Business Tax Sales Tax

Sales Taxes In The United States - Wikiwand

2

2

2

State Law Bans Food Scraps From The Trash Starting July 1 2020 - Mendon Vt Mendon Vt - Mendon Vermont

2

States With Highest And Lowest Sales Tax Rates

2

2

Sales Tax On Grocery Items - Taxjar

Is Clothing Taxable In Vermont - Taxjar

Sales Taxes In The United States - Wikiwand

Comments

Post a Comment