Please contact the office of the general counsel for additional information on state sales tax exemptions. Manufacturer’s must be certified by the louisiana department of revenue and present that certification to the jefferson parish sheriff’s office, bureau of taxation and revenue and register with to get a jefferson parish certificate of exemption for local.

Nolagov

Certified parish manufacturers can qualify for 100% exclusion from local sales and use taxes on qualified manufacturing equipment.

Jefferson parish sales tax exemption certificate. Those persons claiming an exemption from jefferson parish sales tax must provide a valid exemption certificate to support their claim. Add the date to the template with the date feature. 200 derbigny street, suite 4400.

The link below will take you to the jefferson parish sheriff's office 'forms and tables' page of their web site. Parish purchases are exempt from use tax, louisiana state sales tax, and jefferson parish sales tax, as per act 616, amending title 47 of the louisiana revised statutes, by addition of section 305.29 and parish ordinance no. Make sure that every field has been filled in correctly.

Manufacturer’s must be certified by the louisiana department of revenue and present that certification to the jefferson parish sheriff’s office, bureau of taxation and revenue and register with to get a jefferson parish certificate of exemption for local parish taxes exclusion. 1 hours ago jefferson parish sales tax form fill and sign printable. Request to renew jefferson parish sales tax certificates.

Ad access any form you need. Airport district tax in addition to the sales/use tax imposed on transactions occurring in jefferson parish, an additional levy is imposed on. Certified parish manufacturers can qualify for 100% exclusion from local sales and use taxes on qualified manufacturing equipment.

In addition to the sales tax levied on the furnishing of rooms by hotels, motels, and tourist camps, an occupancy tax is imposed on the paid occupancy of hotel/motel rooms located in the parish of jefferson. Click the sign icon and create an electronic signature. Download or email fillable forms, try for free now!

Newell normand jefferson parish sheriff s office bureau of revenue and taxation p. The assessment date is the first day of january of each year. Next, enter your business name (seller’s business name) as it appears on your sales tax registration certificate.

Feel free to use three options; A separate tax return is used to report these sales. You can find the sales/use tax registration form there:

Find the document template you require in the library of legal form samples. Vendor must furnish federal excise tax exemption certificates. Complete, edit or print your forms instantly.

Download form by clicking on title below: Typing, drawing, or uploading one. Jefferson parish sales tax forms.

Below is a chart of the current sales tax exemptions for tulane university. All exemption certificates must be presented at the time of the transaction and a copy should be kept on file. Enter your sales tax account number (seller’s la account number) as it appears on your sales tax registration certificate.

Oct 31, 2021 · purchases for this project shall be exempt from state sales and use tax according to la. Press enter. once your account number has been confirmed, the resale certificate. Just now execute jefferson parish sales tax form in a couple of clicks by simply following the guidelines below:

A resale certificate allows businesses to purchase items without paying the sales tax if the items will be resold in the normal course of operating the business. 1855 ames blvd., suite a. Dealers purchasing items for resale must provide their vendors with a city of new orleans resale certificate to certify the items they purchase are for resale and to show the dealer should not be charged sales tax.

Faqs Jefferson Parish Sheriffs Office La Civicengage

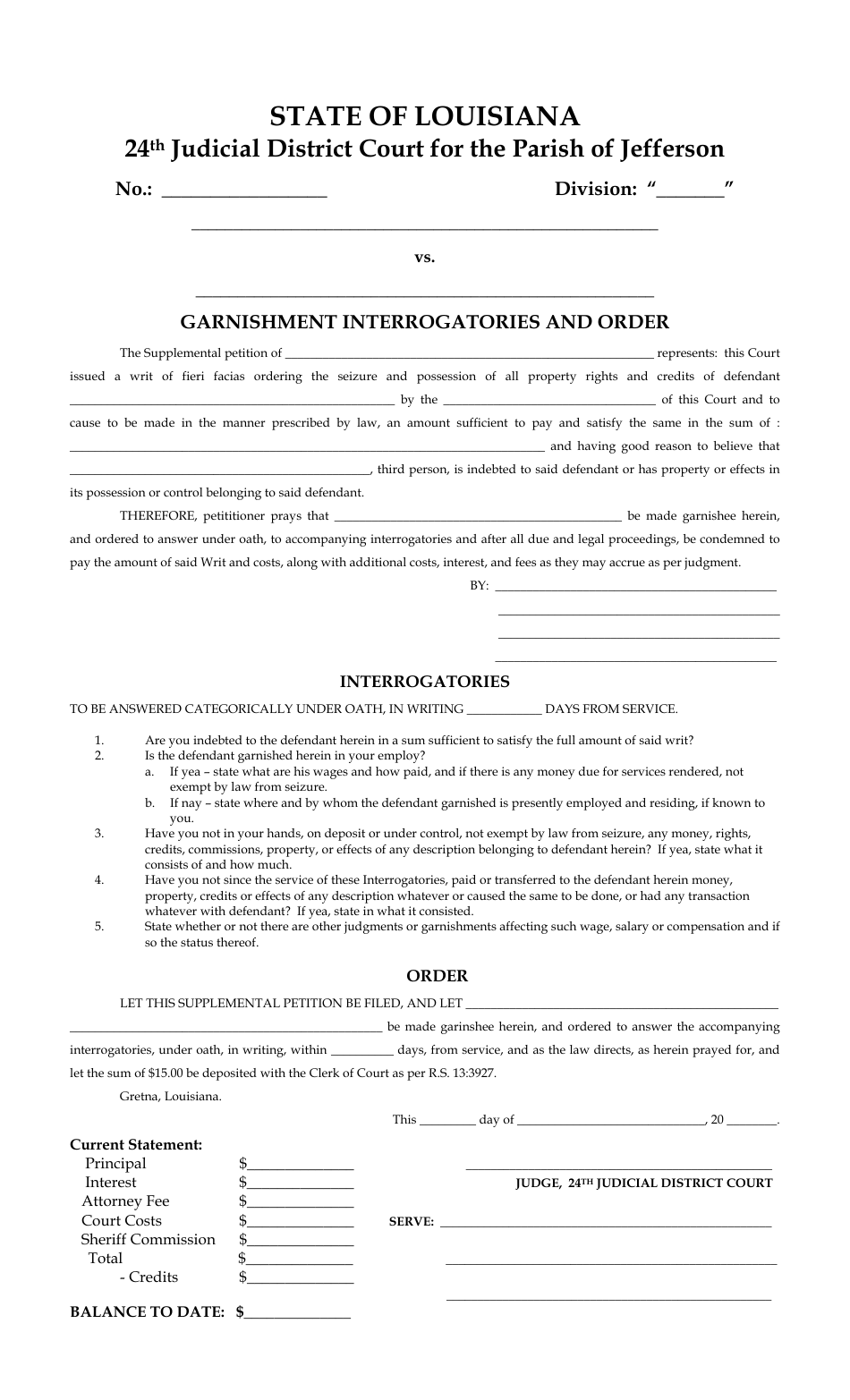

Parish Of Jefferson Louisiana Garnishment Interrogatories And Order Form Download Fillable Pdf Templateroller

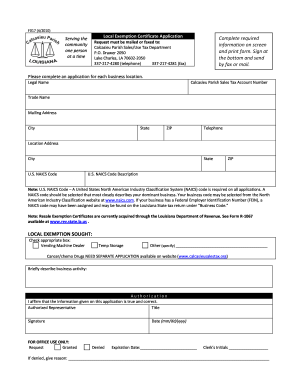

Calcasieu Parish Sales Tax Form - Fill Out And Sign Printable Pdf Template Signnow

Jefferson Parish Sales Tax Exemption Certificate - Fill Online Printable Fillable Blank Pdffiller

Jpsocom

Jefferson Parish Sales Tax Exemption Certificate - Fill Online Printable Fillable Blank Pdffiller

Appllastatelaus

Nola Film Automotive - Nola Movie Cars - Picture Car Rentals In New Orleans Louisiana - Picture Vehicles - Movie Vehicles

Jefferson-parish-governmentazureedgenet

Nola Film Automotive - Nola Movie Cars - Picture Car Rentals In New Orleans Louisiana - Picture Vehicles - Movie Vehicles

Wwwcfprddoalouisianagov

Jefferson Parish Sales Tax Exemption Certificate - Fill Online Printable Fillable Blank Pdffiller

Appllastatelaus

Jefferson Parish Sales Tax Exemption Certificate - Fill And Sign Printable Template Online Us Legal Forms

Wwwcfprddoalouisianagov

Jefferson-parish-governmentazureedgenet

Llalagov

Nola Film Automotive - Nola Movie Cars - Picture Car Rentals In New Orleans Louisiana - Picture Vehicles - Movie Vehicles

Faqs Jefferson Parish Sheriffs Office La Civicengage

Comments

Post a Comment