Nebraska collects a 5.5% state sales tax rate on the purchase of all vehicles. 1, the village of orchard will start a 1.5% local sales and use tax.

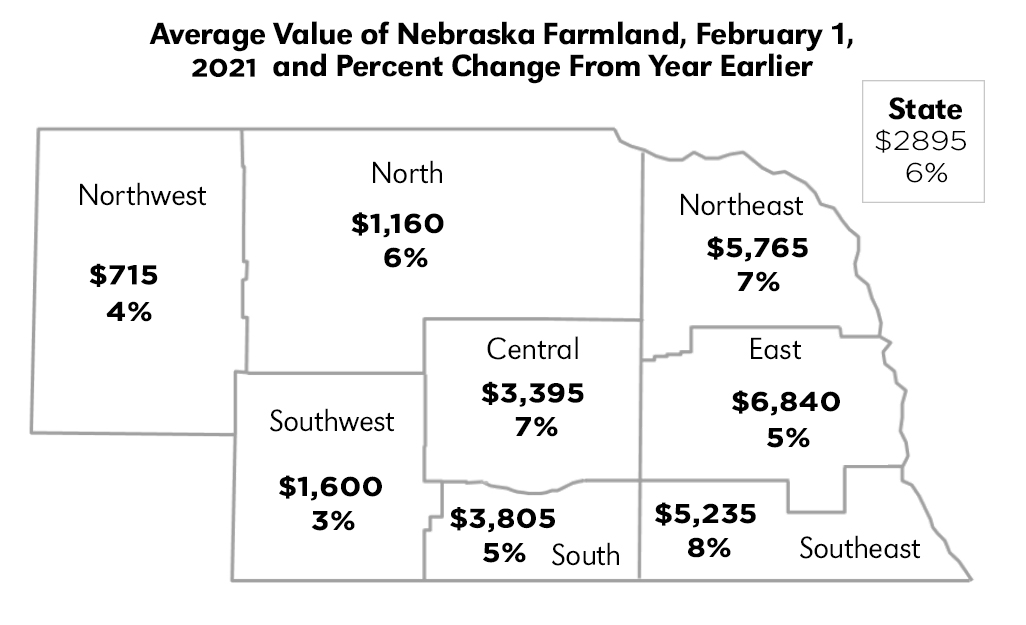

Nebraska Farm Real Estate Report Center For Agricultural Profitability

8% is the highest possible tax rate ( beatrice, nebraska) the average combined rate of every zip code in nebraska is 6.051%.

Lincoln ne sales tax 2020. Nebraska tax forms are sourced from the nebraska income tax forms page, and are updated on a yearly basis. The total rate column has an *. The minimum combined 2021 sales tax rate for lincoln, nebraska is.

Lincoln, ne sales tax rate the current total local sales tax rate in lincoln, ne is 7.250%. Nebraska has state sales tax of 5.5%, and allows local governments to collect a local option sales tax of up to 2%. The 2021 state personal income tax brackets are updated from the nebraska and tax foundation data.

The nebraska state sales and use tax rate is 5.5% (.055). 5.5% is the smallest possible tax rate ( abie, nebraska) 6%, 6.5%, 7%, 7.25%, 7.5% are all the other possible sales tax rates of nebraska cities. 1, the company announced friday.

The latest sales tax rates for cities in nebraska (ne) state. The decision could generate millions of dollars in additional tax. There is no applicable county tax or special tax.

Download our nebraska sales tax database! The december 2020 total local sales tax rate was also 7.250%. Local sales and use tax rates effective july 1, 2020 • dakota county and gage county each impose a tax rate of 0.5%.

1, 2020, deshler will collect a new 1% sales and use tax, while. Lancaster county, nebraska has a maximum sales tax rate of 7.25% and an approximate population of 220,196. Before the official 2021 nebraska income tax rates are released, provisional 2021 tax rates are based on nebraska's 2020 income tax brackets.

Future job growth over the next ten years is predicted to be 31.1%, which is lower than the us average of 33.5%. Please make sure the nebraska forms you are using. There are a total of 295 local tax jurisdictions across the state, collecting an average local tax of 0.547%.

Create your own online store and start selling today. The nebraska state sales tax rate is 5.5%, and the average ne sales tax after local surtaxes is 6.8%. Groceries are exempt from the nebraska sales tax.

The county sales tax rate is %. Online retailer amazon plans to start collecting sales taxes on purchases in nebraska on jan. This is the total of state, county and city sales tax rates.

The lincoln sales tax rate is %. Notification to permitholders of changes in local sales and use tax rates effective january 1, 2022. Sales tax rates in lancaster county are determined by four different tax jurisdictions, lancaster, panama, lincoln and waverly.

Create your own online store and start selling today. Click here for a larger sales tax map, or here for a sales tax table. Rates include state, county and city taxes.

Try it now & grow your business! The us average is 6.0%. Try it now & grow your business!

2020 rates included for use while preparing your income tax deduction. There is no applicable county tax or special tax. Counties and cities can charge an additional local sales tax of up to 2%, for a maximum possible combined sales tax of 7.5%.

The nebraska sales tax rate is currently %. The 7.25% sales tax rate in lincoln consists of 5.5% nebraska state sales tax and 1.75% lincoln tax. The state sales tax in.

In addition to taxes, car purchases in nebraska may be subject to other fees like registration, title, and plate fees. Lincoln has seen the job market increase by 1.5% over the last year. You can find these fees further down on the page.

Nebraska state rate (s) for 2021. See the county sales and use tax rates section at the end of this listing for information on how these counties are treated differently. Lincoln has an unemployment rate of 2.9%.

Baierl Ford Doorbuster Black Friday Newspaper Ad Newspaper Design Print Ads Ads

New Ford Explorer For Sale In Lincoln Ne Anderson Ford Lincoln

10 Soft Skills To Enable Positive Teamwork In Design By Priyanka J Jul 2020 Muzli - Design Ins Home Business Marketing Professional Business Performance

Document Management Proposal Template Request For Proposal Proposal Templates Business Proposal Template

Vehicle And Boat Registration Renewal Nebraska Dmv

Collection Letters To Customers Elegant 10 Sample Collection Letters Sample Letters W Collection Letter Simple Cover Letter Template Cover Letter Template Free

Fitness Pal_14_20190323163733_52 Saratoned On My Fitness Journey Sunny Health And Fitness Indoor Cycling B Nutrition Healthy Foods To Eat Banana Benefits

Contact Us Nebraska Department Of Revenue

Master Closet Master Bath And Closet Master Closet Home

Pin On Real Estate Information

2020 Nebraska Property Tax Issues Agricultural Economics

Nebraska State Tax Things To Know Credit Karma Tax

Ibex Cargo Services Islamabad Cargo Services Cargo Custom

Best Visa Credit Cards Of June 2020 - Cnbc Visa Platinum Card Visa Credit Visa Credit Card

Pin On Pennsylvania Magazine

Pwsrbb6vozcqam

Genos Bar And Grill Wins Dillon Harley Chili Cookoff In Omaha Dillon Chili Cook Off Harley

Contact Us Nebraska Department Of Revenue

3611 Thomas Ave N Minneapolis Mn 55412 Mls 5654150 Zillow Zillow Minneapolis Property

Comments

Post a Comment