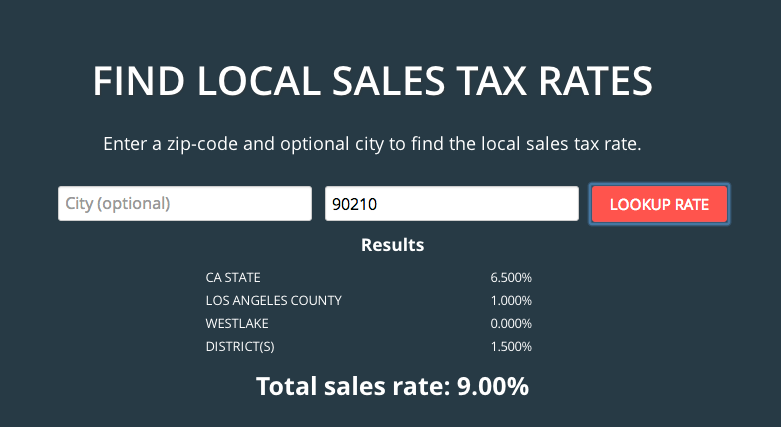

The 8.1% sales tax rate in tempe consists of 5.6% arizona state sales tax, 0.7% maricopa county sales tax and 1.8% tempe tax. The december 2020 total local sales tax rate was also 6.300%.

Arizona Sales Tax - Taxjar

This is the total of state, county and city sales tax rates.

Tempe az sales tax rate 2020. The tempe, arizona sales tax is 8.10% , consisting of 5.60% arizona state sales tax and 2.50% tempe local sales taxes.the local sales tax consists of a 0.70% county sales tax and a 1.80% city sales tax. There are a total of 101 local tax jurisdictions across the state, collecting an average local tax of 2.146%. This table shows the total sales tax rates for all cities and towns in maricopa.

The current total local sales tax rate in tempe junction, az is 6.300%. If this rate has been updated locally, please contact us and we will update the sales tax rate for tempe, arizona. Look up sales tax rates for tempe, arizona, and surrounding areas.

If you need access to a database of all arizona local sales tax rates, visit the sales tax data page. Failing to do so will result in a $25 penalty from ador. Not taxed by state & county mctc section 445:

Even if you had no sales and/or tax due for a filing period, you must still file a $0 tpt return on aztaxes.gov. Depending on the zipcode, the sales tax rate of tempe may vary from 5.6% to 8.1% depending on the zipcode, the sales tax rate of tempe may vary from 5.6% to 8.1% Average sales tax (with local):

The county sales tax rate is %. Arizona has state sales tax of 5.6% , and allows local governments to collect a local option sales tax of up to 5.3%. Try it now & grow your business!

Use the physical address or the zip code, or if it is unknown, the map locator link can be used to find the location. The combined rate used in this calculator (. How much is sales tax in tempe in arizona?

Create your own online store and start selling today. Atra is the most respected independent and accurate source of public finance and tax policy in arizona. Arizona has recent rate changes(wed jan 01 2020).

There is no applicable special tax. Atra is nonprofit and nonpartisan. Phoenix, az sales tax rate the current total local sales tax rate in phoenix, az is 8.600%.

City of tempe (except city holidays) tax and license: Select the appropriate business description and the state/county and city (if. The tempe, arizona, general sales tax rate is 5.6%.

The sales tax rate for tempe was updated for the 2020 tax year, this is the current sales tax rate we are using in the tempe, arizona sales tax comparison calculator for 2022/23. The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. Arizona tax rate look up resource.

File & pay tpt monthly aztaxes.gov The tempe sales tax is collected by the merchant on. The december 2020 total local sales tax rate was also 8.600%.

Try it now & grow your business! The tempe sales tax rate is %. There is a minimum of $25 and a maximum 25 percent of the tax due or $100, per return, whichever is greater.

Arizona has a 5.6% sales tax and maricopa county collects an additional 0.7%, so the minimum sales tax rate in maricopa county is 6.3% (not including any city or special district taxes). This resource can be used to find the transaction privilege tax rates for any location within the state of arizona. The 85281, tempe, arizona, general sales tax rate is 8.1%.

2020 rates are provided by avalara and updated monthly. The arizona sales tax rate is currently %. Arizona (az) sales tax rates by city (t) the state sales tax rate in arizonais 5.600%.

Sales tax calculator| sales tax table. Click any locality for a full breakdown of local property taxes, or visit our arizona sales tax calculator to lookup local rates by zip code. The 85281, tempe, arizona, general sales tax rate is 8.1%.

For tax rates in other cities, see arizona sales taxes by city and county. Create your own online store and start selling today. You can print a 8.1% sales tax table here.

The combined rate used in this calculator (8.1%) is the result of the arizona state rate (5.6%), the 85281's county rate (0.7%), the tempe tax rate (1.8%). With local taxes, the total sales tax rate is between 5.600% and 11.200%. Sales tax in tempe, arizona, is currently 8.1%.

The minimum combined 2021 sales tax rate for tempe, arizona is.

Is Food Taxable In Arizona - Taxjar

Free W11 Form 11 The History Of Free W11 Form 11 Tax Forms Irs Forms Fillable Forms

Arizona Sales Tax Rates By City County 2021

Rate And Code Updates Arizona Department Of Revenue

Submit The Irs Form 1099-misc Online Get Fillable And Printable Miscellaneous Income Template With Detailed Instructions Easily Fillable Forms Irs Forms Irs

Arizona State Tax Tables 2020 Tax Rates Brackets Tax

W2 Independence A New More Inclusive Umbrella For The Fire Community Rental Agreement Templates W2 Forms Templates

Generate Your Stub - Final Review - Paystubcreatornet Company Address Pay Stub Create Yourself

Arizona Sales Tax - Small Business Guide Truic

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Arizona Sales Tax - Small Business Guide Truic

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

How To Collect Sales Tax Through Square - Taxjar

Will Your Stimulus Check Come Out Of Your 2020 Tax Return Report Answers The Question - Pennlivecom Checks Social Security How To Plan

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Tax Guide

Whats The Arizona Tax Rate Credit Karma Tax

Comments

Post a Comment