How 2021 sales taxes are calculated in orange. Wednesday, november 17 @ 10am registrations must be completed online prior to november 15 at 4pm.

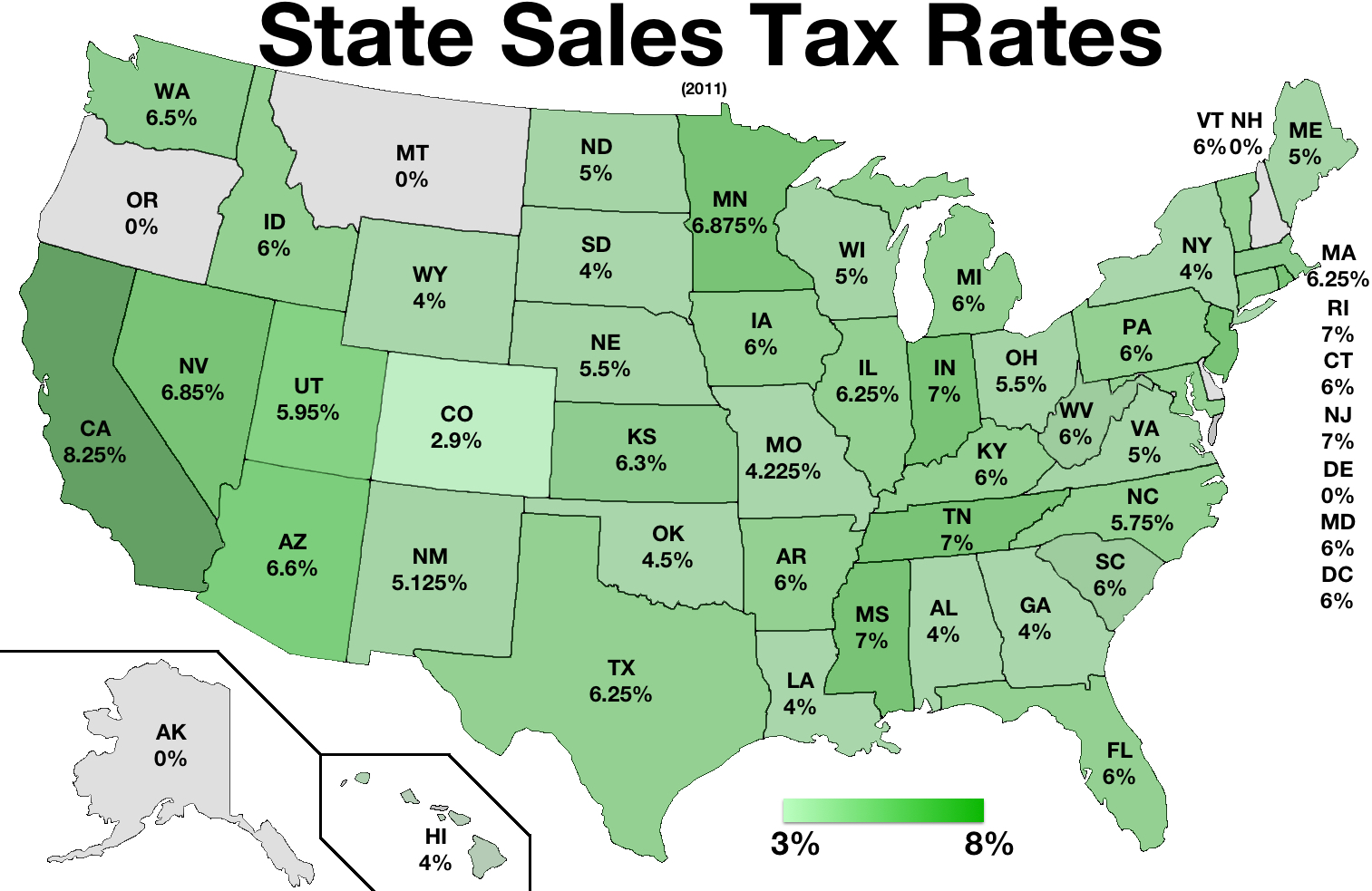

Sales Taxes In The United States - Wikiwand

An additional sales tax rate of 0.375% applies to taxable sales made within the metropolitan commuter transportation district (mctd).

Orange county ny sales tax calculator. The 2018 united states supreme court decision in south dakota v. Bronx, kings (brooklyn), new york (manhattan), queens, richmond (staten island), dutchess, nassau, orange, putnam, rockland, suffolk, and westchester If this rate has been updated locally, please contact us and we will update the sales tax.

The orange, california, general sales tax rate is 6.5%.depending on the zipcode, the sales tax rate of orange may vary from 6.5% to 7.75% every 2021 combined rates mentioned above are the results of california state rate (6.5%), the county rate (0.25%), and in some case, special rate (1.5%). Has impacted many state nexus laws and sales tax collection requirements. If you don't want to do a calculation, but want to know the complete sales tax rates in a particular city of new york state, click here.

Sales tax in orange county, new york, is currently 8.13%. Property information * property state: , ny sales tax rate.

New york has 2,158 cities, counties, and special districts that collect a local sales tax in addition to the new york state sales tax.click any locality for a full breakdown of local property taxes, or visit our new york sales tax calculator to lookup local rates by zip code. Some information relating to property taxes is provided below: Sales taxes for a city or county in new york can be as high as 4.75%, meaning you could potentially pay a total of 8.75% sales tax for a vehicle in the state.

Sales tax (see sales tax information) title certificate fee of $50.00; Tax certificate sale real estate taxes become delinquent on april 1 of each year. The december 2020 total local sales tax rate was also 8.125%.

For comparison, the median home value in new york is $306,000.00. See detailed property tax report for 71 meadow road, orange county, ny. After real estate taxes become delinquent, they are advertised in a local newspaper once per week for three consecutive weeks.

The lowest city tax rate in new york. New york has a 4% statewide sales tax rate, but also has 987 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 4.23% on top of the state tax. The combined rates vary in each county and in.

If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact your county or city's. The sales tax rate for orange county was updated for the 2020 tax year, this is the current sales tax rate we are using in the orange county, new york sales tax comparison calculator for 2022/23. The office of the tax collector is responsible for collecting taxes on all secured and unsecured property in orange county.

Office of the clerk of the board. The ttc shall not be responsible or liable for any losses, liabilities or damages resulting from an incorrect apn, property address, purchase. The orange county sales tax rate is %.

If you need access to a database of all new york local sales tax rates, visit the sales tax data page. 101 rows how 2021 sales taxes are calculated for zip code 10940. The combined sales and use tax rate equals the state rate (currently 4%) plus any local tax rate imposed by a city, county, or school district.

If you leased the vehicle, see register a leased vehicle. Counties, cities, towns, villages, school districts, and special districts each raise money through the real property tax. This tool can calculate the transfer/excise taxes for a sale or reverse the calculation to estimate the sales price.

The dmv calculates and collects the sales tax, and issues a sales tax receipt. The advertising and collection cost is added to the delinquent bill. This means that, depending on your location within new york, the total tax you pay can be significantly higher than the 4% state sales tax.

There is no city sale tax for orange. The money funds schools, pays for police and fire protection. This office is also responsible for the sale of property subject to the power to sell, properties that have unpaid property taxes that have been delinquent over five years.

To use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). The new york state sales tax rate is currently %. A general purpose sales tax calculator is also provided to calculate sales tax in new york state for any purchase cost, in any taxing jurisdiction.

The current total local sales tax rate in middletown, ny is 8.125%. Mctd 1 fee for the following 12 counties only: On or before june 1, the tax collector must conduct […]

In new york state, the real property tax is a tax based on the value of real property.

Sales Taxes In The United States - Wikiwand

How To Charge Your Customers The Correct Sales Tax Rates

2

New York Sales Tax Calculator Reverse Sales Dremployee

Excise Tax What It Is How Its Calculated

North Carolina Income Tax Calculator - Smartasset

How To Calculate Cannabis Taxes At Your Dispensary

Arizona Sales Tax - Small Business Guide Truic

Sales Taxes In The United States - Wikiwand

Why Do Us Sales Tax Rates Vary So Much

Florida Has The 4th Highest Cell Phone Tax Rate In The Us Florida Chamber Of Commerce

How Much Gas Tax Money States Divert Away From Roads - Reason Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Calculator - Taxjar

North Carolina Nc Car Sales Tax Everything You Need To Know

How To Calculate Cannabis Taxes At Your Dispensary

How To Calculate California Sales Tax 11 Steps With Pictures

Which Cities And States Have The Highest Sales Tax Rates - Taxjar

Sales Taxes In The United States - Wikiwand

Comments

Post a Comment