Depending on the zipcode, the sales tax rate of everett may vary from 9.8% to 10.4%. The washington (wa) state sales tax rate is currently 6.5%.

Washington Sales Tax - Small Business Guide Truic

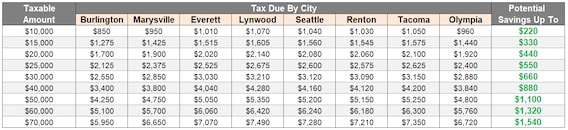

For example, for a taxable gross revenue amount of:

Everett wa sales tax calculator. Salary.com's cost of living calculator lets you compare the cost of living and salary differentials state to state or over 300+ us cities. ∙ 1305 57th st sw unit b/z2, everett, wa 98203 ∙ $475,000 ∙ mls# 1864705 ∙ great opportunity to own a beautiful home in the popular keaton's landing commu. Or spirits, you’re likely going to need some type of beverage alcohol license.

The present tax rate is 0.1% (0.001). You’ll find rates for sales and use tax, motor vehicle taxes, and lodging tax. The current total local sales tax rate in everett, wa is 9.800%.

Business and occupation tax rate. This new hyundai car is priced at $23700 and available for a test drive at lee johnson hyundai of everett. Sales tax calculator | sales tax table the state sales tax rate in washington is 6.500%.

Compare the cost of living in everett, washington against another us cities and states. This is multiplied by your gross receipts to compute your taxes due. There are approximately 57,959 people living in the everett area.

Columbus, ohio vs everett, washington. Your everett cafe or restaurant may require a general license for all types of alcoholic beverages, or a license just for beer and wine. The december 2020 total local sales tax rate was also 9.800%.

Calculating the graduated state real estate excise tax: 98201, 98203, 98205, 98207 and 98213. With local taxes, the total sales tax rate is between 7.000% and 10.500%.

New 2022 hyundai venue sel for sale in everett, wa. The everett, washington, general sales tax rate is 0%.the sales tax rate is always 0% every 2017 q3 combined rates mentioned above are the results of washington state rate (0%). A downloadable tax calculator workbook using microsoft excel that displays tax rates and location codes, calculates totals, and summarizes sales by city or county without an online connection.

Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Look up a tax rate. The minimum combined 2021 sales tax rate for everett, washington is.

The everett, washington sales tax rate of 9.8% applies to the following five zip codes: How 2021 sales taxes are calculated in everett. Depending on local municipalities, the total tax rate can be as high as 10.4%.

101 rows how 2021 sales taxes are calculated for zip code 98201. $100,000, the business pays $100. Decimal degrees (between 45.0° and 49.005°) longitude:

2021 cost of living calculator: A salary of $73,000 in columbus, ohio should increase to $104,816 in everett, washington (assumptions include homeowner, no child care, and taxes are not considered. 101 rows how 2021 sales taxes are calculated for zip code 98204.

Working together to fund washington's future. 5 beds, 3 baths ∙ 2907 sq. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

∙ 4618 31st ave se, everett, wa 98203 ∙ $799,000 ∙ mls# 1864839 ∙ immaculate 2019 polygon home in the coveted overlook at riverfront community. Every 2021 combined rates mentioned above are the results of washington state rate (6.5%), the everett tax rate (0% to 3.3%), and in some case, special rate. Find business licenses for everett.

Even if your county rate is 1% and your city rate is 0.75%, your total general rate will still be 1%. Search by address, zip plus four, or use the map to find the rate for a specific location. An alternative sales tax rate of 10.4% applies in the tax region snohomish county unincorp.p.t.b.a., which appertains to zip codes 98204, 98206 and 98208.

This is the total of state,. If the total sale price is $600,000, then the first $500,000 is taxed at 1.10%. How 2017 q3 sales taxes are calculated in everett.

The everett, washington sales tax is 9.70%, consisting of 6.50% washington state sales tax and 3.20% everett local sales taxes.the local sales tax consists of a 3.20% city sales tax. Washington has a 6.5% statewide sales tax rate , but also has 218 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an. To calculate sales and use tax only.

Penalties and interest are due if tax forms are not filed and taxes are not paid by the due date. The everett, washington, general sales tax rate is 6.5%. There is no county sale tax for everett, washington.there is.

3 beds, 2.5 baths ∙ 1770 sq. See what you'll need to earn to keep your current standard of living wherever you choose to work and live. The everett sales tax is collected by the merchant on all qualifying sales made within everett;

Groceries are exempt from the everett and washington state sales taxes

The Snohomish County Washington Local Sales Tax Rate Is A Minimum Of 65

Why Are Property Taxes Higher As A Percentage In Austin Than They Are Even In Seattle - Quora

Economy In Everett Washington

Everett Washington Wa Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Everett Washington Wa Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Why Are Property Taxes Higher As A Percentage In Austin Than They Are Even In Seattle - Quora

Washington Income Tax Calculator - Smartasset

How To Calculate Sales Tax - Video Lesson Transcript Studycom

Washington Income Tax Calculator - Smartasset

Washington Income Tax Calculator - Smartasset

Economy In Everett Washington

How To Record Washington State Sales Tax In Quickbooks Online - Evergreen Small Business

What Is The Tax Rate In Seattle Usa - Quora

Why Are Property Taxes Higher As A Percentage In Austin Than They Are Even In Seattle - Quora

Auto Sales Tax Calculator Buy A Vw Near Marysville Wa

2

Free Lifetime Limited Warranty - Everett Wa Klein Honda

13127 Meridian Ave S Everett Wa 98208 - Realtorcom

Graduated Real Estate Tax Reet For Snohomish County

Comments

Post a Comment