You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction, and your invididual circumstances. Navigating to the tax reports page also shows us the total capital gains.

.jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2021 Cryptotradertax

Calculate and report your crypto taxes bitcoin, ether and 11k+ other coins.

Cryptocurrency tax calculator us. The $5 worth of coins received is considered income for tax purposes. We can see the gain/loss on each transaction clearly. How is crypto tax calculated in the united states?

The new software as a service (saas) application simplifies the process of us tax filings for those who hold cryptocurrency assets and need. This guide is our way of helping you better understand your crypto tax obligations for the 2020 tax season and detail coinbase resources available to you that makes the process easier. Fair market value is simply the price an asset would sell for on the open market.

Crypto tax software is integrated with major crypto exchanges, blockchains, and wallets, and can help you with reporting and filing your crypto taxes. It has a smooth and instinctive ui and is ideally suited for both established traders and unskilled blockchain fans holding comparatively smaller numbers of cryptocurrencies. They calculate your gains or losses and automatically populate tax reports with your data.

Whatever crypto sales gains you would have reported for your 2019 taxes should have been included in your 2019 tax return due july 15, 2020. Ey launches cryptocurrency tax calculator for us customers. Separate calculation of the cost basis for each account.

They compute the profits, losses, and income from your investing activity based off this data. Cryptocurrency tax calculators work by retrieving data from your exchanges, wallets, and other cryptocurrency platforms. Tokentax is one of the most extensive tax calculation and reporting software out there for any crypto trader.

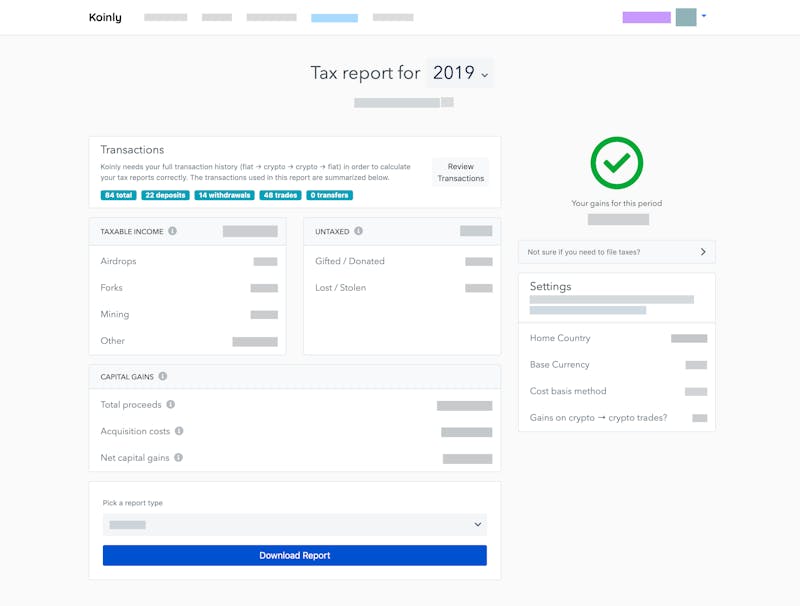

There’s a lot of conflicting content out there, but make no mistake: On march 17, 2021, the irs announced a similar extension for 2020 tax filings from april 15, 2021, to may 17, 2021. After entering the 3 transactions into koinly manually, this is the output:

Automated crypto trading with haru. At zenledger, you can use our crypto tax calculation software to simplify tax reporting and financial analysis in compliance with the irs and the sec rules and regulations. What is fair market value?

The irs states that hard forks are considered income if you receive an additional cryptocurrency asset. By creating an account, you agree to our terms and privacy policy. Now that you are clear on how to use our crypto tax calculator and what taxes you will pay on crypto, consider how you.

To measure the crypto taxes the apps like koinly which is a free online crypto tax calculator can be used. The platform supports more than 100 exchanges, a variety of defi protocols, and is one of the few currently in existence accurately supporting binance smart chain and nfts. How do you calculate your crypto taxes?

Your tax authority wants to know your equivalent profits or losses in the local fiat (usd, gbp, aud, or cad). All coins listed on coinmarketcap supported. $7,000 x 5 percent = $350 state taxes owed $1,050 + $350 = $1,400 total tax liability for transaction #2.

Whether you are filing yourself, using a tax software like turbotax or working with an accountant. Best crypto tax reporting and calculation software: To calculate the crypto taxes for john we are going to use koinly which is a free online crypto tax calculator.

Bitcoin tax calculator get your bitcoin taxes easily done and stay safe from the irs. Crypto tax calculator is a software tool allowing users to calculate taxes on virtual currency trading activity. Filing your cryptocurrency taxes correctly is not as difficult as it may first seem.

With full logs of all your transactions stored by binance, and tax software that will automatically crunch the numbers and calculate how much tax you owe, it’s never been easier to invest in crypto and keep everything above board. Crypto tax calculators work by aggregating your data and then automatically linking your cost bases to your sales, using accounting methods like fifo or lifo. Koinly can generate the right crypto tax reports for you.

Global professional services firm ey (ernst & young) has developed a tax calculator as part of its blockchain analyser product suite that automatically calculates capital gains from cryptocurrency transactions. In the future, if steve exchanges the coins, the cgt he pays will be calculated with the cost base being $5. To calculate your capital gains and losses from each of your crypto sells, trades, or disposals, you simply apply the formula:

Global professional services firm ey (ernst & young) has developed a tax calculator as part of its blockchain analyser product suite that automatically calculates capital gains from cryptocurrency transactions. What is a crypto tax calculator? It provides the most accounting transparency of any cryptocurrency tax calculator.

For example, you might need to pay capital gains on profits from buying and selling cryptocurrency, or pay income tax on interest earned when holding crypto. Every transaction can be adjusted or tailored using the grand unified accounting (gua) spreadsheet to fit the investor’s best possible tax outcome using their preferred accounting method. Zenledger is much more than just a free crypto tax calculator.

You are required to report gains and losses on each transaction or when you earn cryptocurrency, even if the gain or loss is not.

Calculate Your Crypto Taxes With Ease Koinly

Cryptocurrency Tax Reports In Minutes Koinly

Crypto Tax Rates Complete Breakdown By Income Level 2021 Cryptotradertax

Uk Cryptocurrency Tax Guide Cointracker

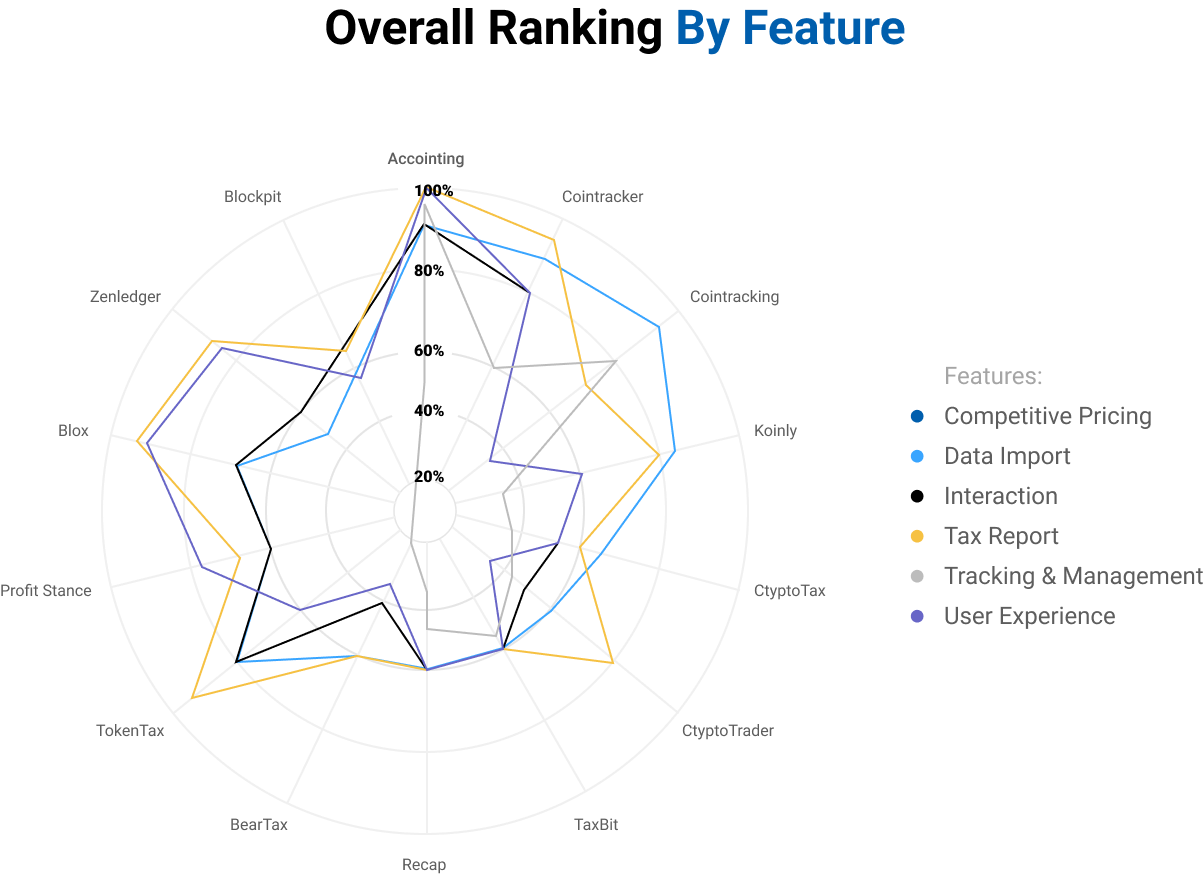

Best Crypto Tax Software In 2021 Coinmonks

Best Bitcoin Tax Calculator In The Uk 2021

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Whats Your Tax Rate For Crypto Capital Gains

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

![]()

Cointracking - Crypto Tax Calculator

![]()

Cointracking - Crypto Tax Calculator

Best Crypto Tax Software In 2021 Coinmonks

Free Bitcoin Tax Calculator Crypto Tax Calculator Taxact Blog

10 Best Crypto Tax Software 2021 Selective

Crypto Tax Calculator

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

5 Best Crypto Tax Software Accounting Calculators 2022

Crypto Tax Calculator File Cryptocurrency Taxes Tokentax

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker

Comments

Post a Comment