How to use sales tax exemption certificates in north dakota. Or a copy of the motor vehicle registration showing sales tax was paid.

How To Get A Sales Tax Exemption Certificate In Colorado - Startingyourbusinesscom

Mm/dd/yyyy) taxpayer name new owner name, address, phone number address city, state, zip code fill in this circle if your address has changed.

Nd sales tax form. Please note that north dakota may have specific restrictions on how exactly this form can be used. Other north dakota sales tax certificates: This form reflects the increased tax rates for clark and churchill counties effective 10/01/05.

Take the sum from line 12, calculate penalty and interest as instructed on line 13, and enter the total due with your. Not all states allow all exemptions listed on this form. This sales tax is utilized by the city of fargo for flood risk protection, mitigation and reduction.

Questions regarding the refund of tax may be directed to the sales & special taxes at 701.328.1246 or. North dakota sales, use and gross receipts tax st step 9: The current sales and use tax rate for most purchases in grand forks is 2.25%.

Section a must be completed in full. Questions regarding the refund of tax may be directed to the sales & special taxes at 701.328.1246 or. Under line 11, consult the chart on the second page to calculate all local option taxes that must be paid.

Sales and use tax forms and certificates. Send the completed form to the seller and keep a copy for your records. Received compensation for the following vehicle:

Wholesalers and distributors will require a sales tax number and a completed north dakota certificate of resale (form sfn 21950) (also referred to as a resale certificate or sales tax exemption certificate) to document the items being purchased are for resale. Copies of all invoices must accompany your request. Owner telephone number mailing address city state zip code.

Salestaxhandbook has an additional one north dakota sales tax. Form title topic year/month type; If claiming a refund of sales and use taxes paid on a motor vehicle, you must include a copy of the nebraska sales/use tax and tire fee statement for motor vehicle and trailer sales, form 6 , which was validated by the county treasurer;

Total sales (do not include tax) 2. Please do not write in this space mail to: This is a streamlined sales tax certificate, which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the streamlined sales and use tax agreement.

Tax return forms & schedules. (1) individual resides within the boundaries of any north dakota reservation, is an enrolled member of any federally recognized indian tribe, and acquires a motor vehicle. Name of lessor name of lessee year make model vin

North dakota sales, use and gross receipts tax st step 10: Office of state tax commissioner. Sales and use tax rates.

Claims for sales and use taxes paid on manufacturing machinery and equipment. North dakota office of state tax commissioner sales & special taxes 600 e. Copies of all invoices must accompany your request.

This is a multistate form. This commenced january 1, 2010 and was to expire on december 31, 2029. The city of grand forks imposes a sales and use tax on purchases made in grand forks.

Lease tax worksheet€ north dakota department of transportation, motor vehicle. Application forms for exemption numbers or direct pay permits. Column a column b 5% sales & purchases.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0 1.

North dakota office of state tax commissioner sales & special taxes 600 e.

Sales And Use Tax Regulations - Article 3

Form 8949 Instructions Information On Capital Gainslosses Form

How To Get A Sales Tax Certificate Of Exemption In Virginia - Startingyourbusinesscom

This Is A Business Forms Form That Can Be Used For Accounting Download This Form For Free Now Businessforms Accou Balance Sheet Accounting Accounts Payable

How To Get A Sales Tax Certificate Of Exemption In North Carolina

How To Get A Resale Certificate In Texas - Startingyourbusinesscom

Printable Washington Sales Tax Exemption Certificates

2016-2021 Nd Form St Fill Online Printable Fillable Blank - Pdffiller

Forms Instructions - Sales North Dakota Office Of State Tax Commissioner

What Is Schedule A Hr Block

Online Sales And Use Tax Return Filing And Payment City Of Longmont Colorado

2

Refund Help North Dakota Office Of State Tax Commissioner

2

Sales And Use Tax Regulations - Article 3

How To Get A Sales Tax Exemption Certificate In Ohio - Startingyourbusinesscom

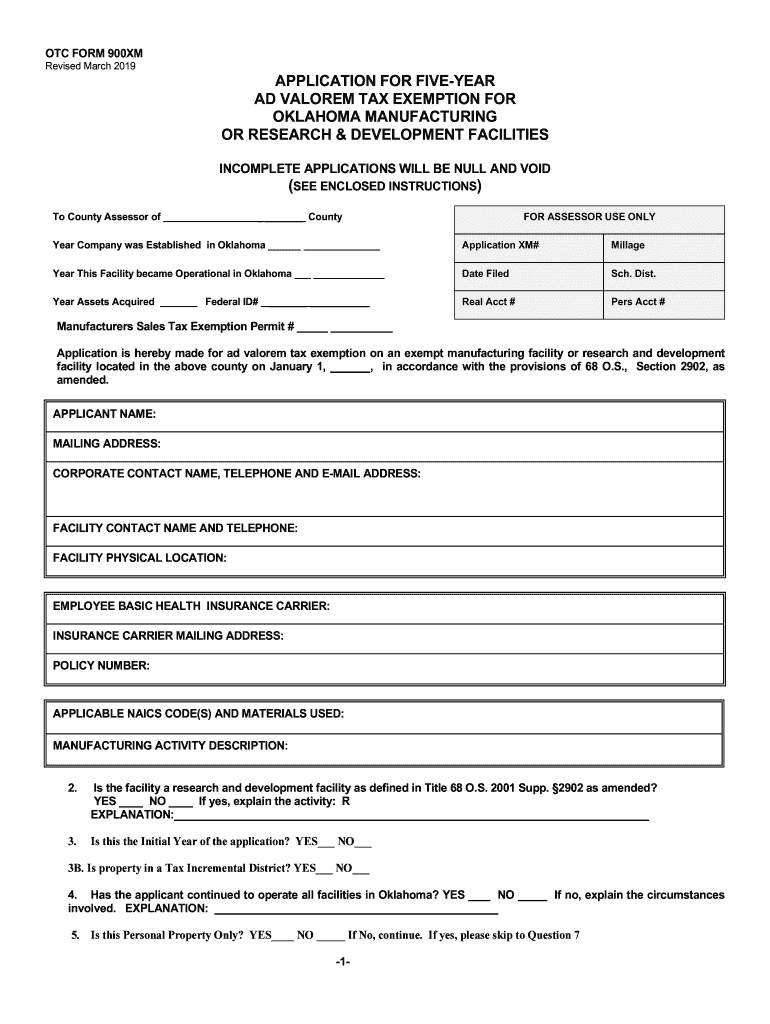

Ok Otc 900xm 2019-2021 - Fill Out Tax Template Online Us Legal Forms

Refund Help North Dakota Office Of State Tax Commissioner

Sales And Use Tax In Nc Roper Accounting Group

Comments

Post a Comment