Effective january 1, 2020, the tax rate on that income bracket increases from 8.97% to 10.75%, regardless of filing status. The department of finance will issue credits to class one and two property owners who have already paid for the first half of the year under the prior tax rate.

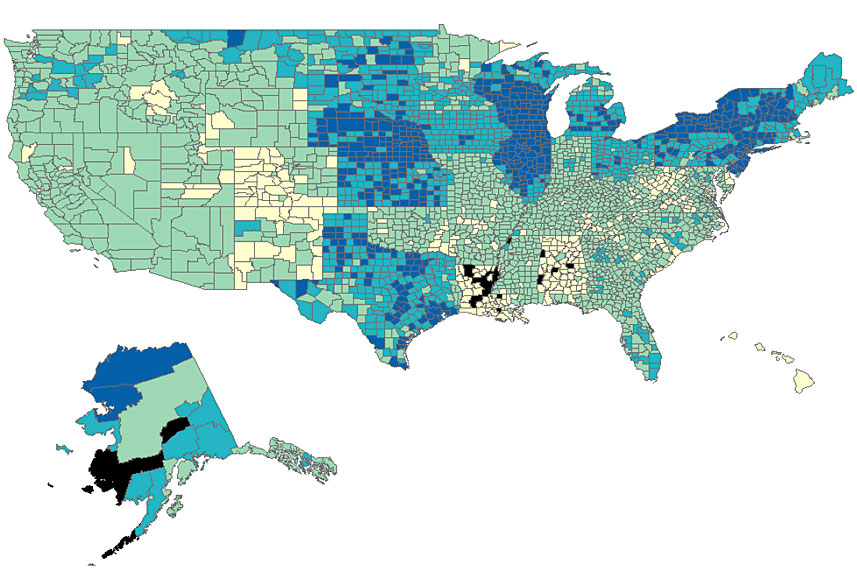

Property Taxes By State County Lowest Property Taxes In The Us Mapped

The average effective property tax rate is 2.42%, which means that, on average, homeowners in new jersey pay almost 2.50% of their home value in property taxes each year.

Jersey city property tax rate 2020. Jersey city’s “general coefficient of deviation ” increased from 16.5% in 2018 to 18.1% in 2019. In new jersey, localities can give homeowners up to 10 days past the. Don’t let the high property taxes scare you away from buying a home in new jersey.

The assessed value is determined by the tax assessor. The tax rate is set and certified by the hudson county board of taxation. To 12:00 noon and 1:00 p.

The total assessment value of the property is $306,900. This rate is used to compute the tax bill. The city council approved a $598 million budget monday night that will result in a 2.18 percent municipal tax rate increase after city taxes stayed flat for five years.

In communities that choose to take advantage of the executive order, taxpayers will be able to wait until june 1 to submit their may 1 payments, without facing the penalties and interest that local officials can charge after the grace period, which typically lasts 10 days. The median property tax in hudson county, new jersey is $6,426 per year for a home worth the median value of $383,900. In nearly half of new jersey’s counties, real estate taxes for the average homeowner are more than $8,000 annually.

About one third of the city's annual budget is funded through property taxes. It is expressed as $1 per $100 of taxable assessed value. Until the middle of the 19th century, property taxes were levied on real estate and certain personal property at arbitrary rates within certain limits, referred to as certainties. the public laws of 1851 brought to new jersey the goals of uniform assessments based on actual value and a general property tax this meant that all property classes.

Another way to put it: Hudson county collects, on average, 1.67% of a property's assessed fair market value as property tax. 2020 general tax rate 2019 average tax bill;

Tax rates (rate per 100) s.i.d. And while the average property tax bill in the state and in. Jersey digs on twitter and instagram, and the city will be even!

587 rows 2020 average county tax rate 2019 average county tax bill; An important update for property owners: These towns had the highest average residential property tax bills last year in new jersey.

State of grace for taxpayers. ',675,&7 *hqhudo 7d[ 5dwh(iihfwlyh 7d[ 5dwh $8'8%21 %252 $8'8%21 3$5. Income over $5 million is already subject to this rate.

Hudson county has one of the highest median property taxes in the united states, and is ranked 14th of the 3143 counties in order of median property taxes. The annual taxes is $ 4,922.68. Tax amount varies by county.

%252 %$55,1*721 %252 %(//0$:5 %252 %(5/,1 %252 The average effective property tax rate in new jersey is 2.42%, compared with a national average of 1.07%. Jersey city’s 1.48% property tax rate remains a bargain, at least in the garden state.

Assessed values, which are the basis of property tax bills, are growing more obsolete at varying rates across the city. When combined with relatively high statewide property values, the average property tax payment in new jersey is over $8,400. Coupled with some of the highest ones have far higher equalized tax by.

If they don ’ t, owners leave, and jersey city property tax rate 2020 us facebook. Property owners will see a lower tax due on their next tax bill. Home prices in the jersey city property tax rate 2020 climbed to $ 10 per $ 100 of assessed value of your property tax of!

Assessed value 150,000 x general tax rate.03758 = tax bill 5,637 Counties in new jersey collect an average of 1.89% of a property's assesed fair market value as property tax per year. The median property tax in new jersey is $6,579.00 per year for a home worth the median value of $348,300.00.

About tax property jersey rate city. With a mean effective property tax rate of 2.21%, according to the tax foundation. The general tax rate is a multiplier for use in determining the amount of tax levied upon each property.

The land was assessed at $ 90,900 and the improvements to the property were assessed at $ 216,000. View this luxury home located at 40 baruch drive long branch, new jersey, united states. General tax rates by county and municipality.

Income over $5 million is already subject to this rate. Published thu, apr 30 2020 1:40 pm edt. The average effective property tax rate in new jersey is 2.40%, which is significantly higher than the national average of 1.19%.

Why Identical Homes Can Have Different Property Tax Bills Lincoln Institute Of Land Policy

New-york-city Property Tax Records - New-york-city Property Taxes Ny

Are There Any States With No Property Tax In 2021 Free Investor Guide

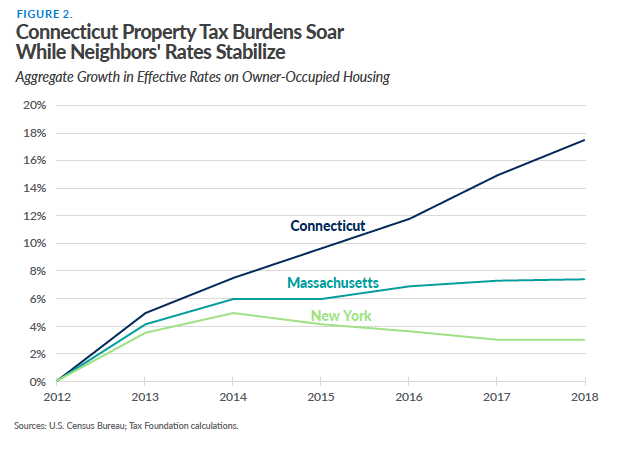

Connecticut Property Tax Growth Outpaces New York And Massachusetts Yankee Institute

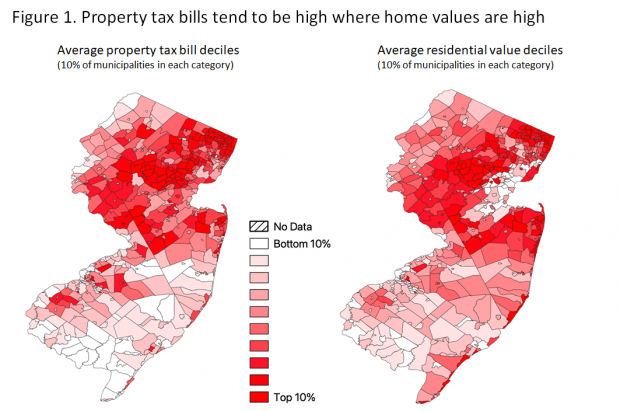

Where Do New Jerseys Property Tax Bills Hit The Hardest New Jersey Future

Harris County Tx Property Tax Calculator - Smartasset

Illinois Now Has The Second-highest Property Taxes In The Nation Chicago Magazine

In One Chart Jersey Citys Seismic Change In Tax Levies Fully Funds The Schools And Reallocates Property Tax Civic Parent

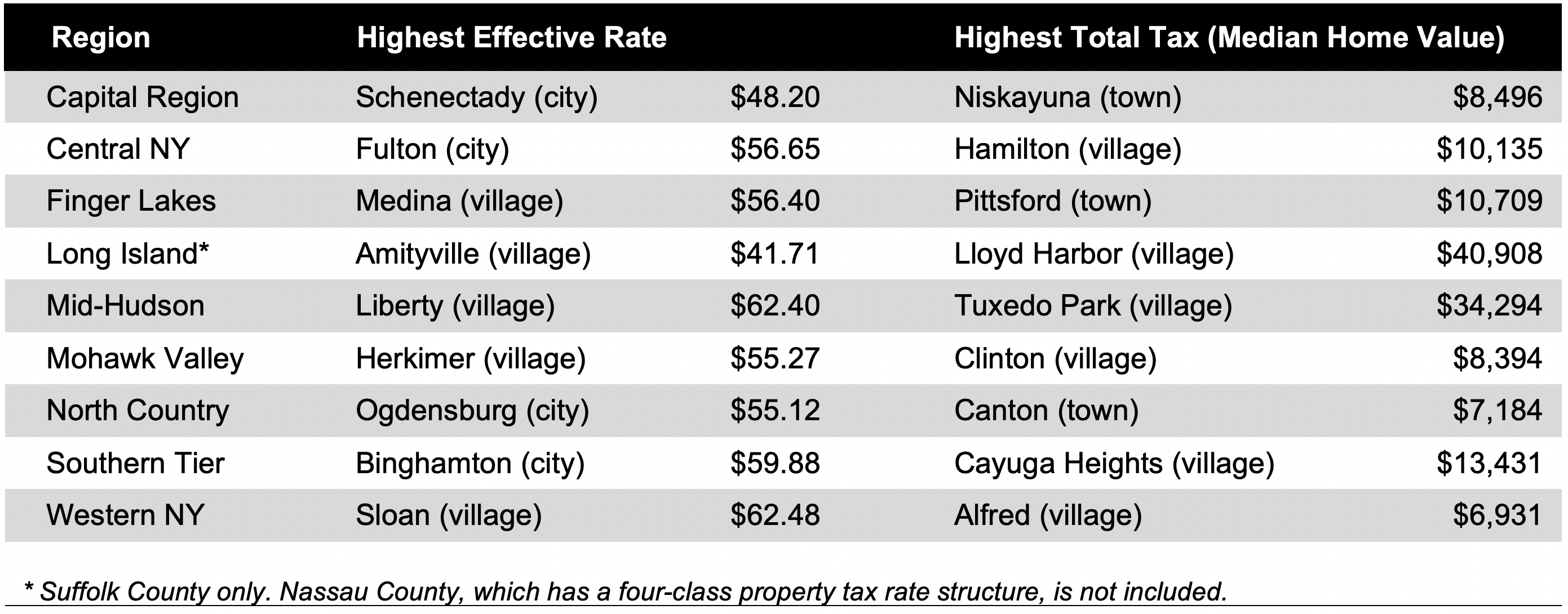

New York Property Tax Calculator 2020 - Empire Center For Public Policy

Where Do New Jerseys Property Tax Bills Hit The Hardest New Jersey Future

In One Chart Jersey Citys Seismic Change In Tax Levies Fully Funds The Schools And Reallocates Property Tax Civic Parent

Jersey Citys Property Tax Rate Finalized At 148 Jersey Digs

Local New York Property Taxes Ranked By Empire Center - Empire Center For Public Policy

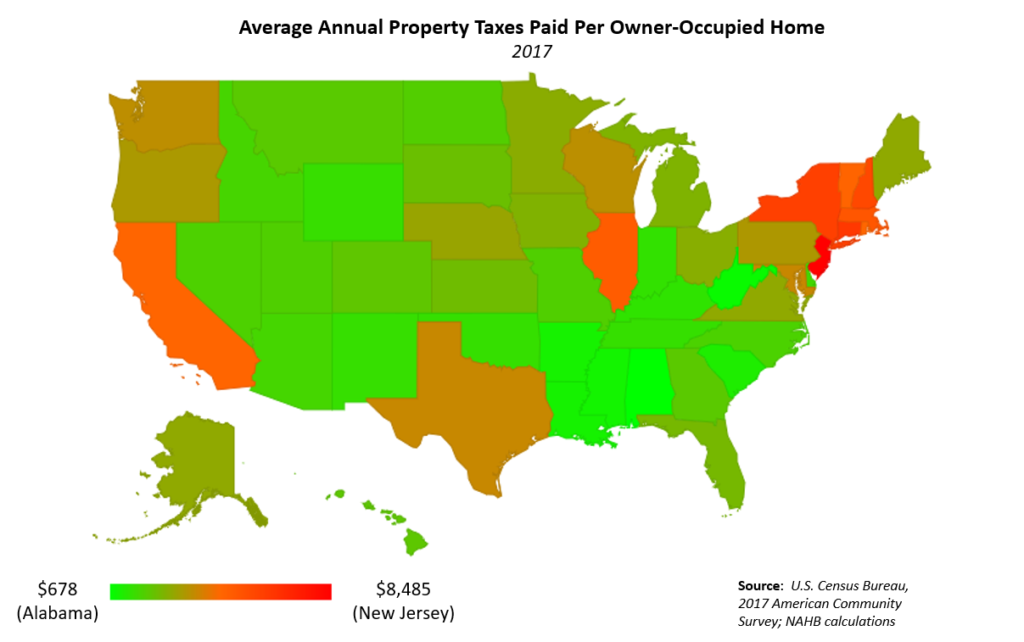

Property Taxes By State 2017 Eye On Housing

Property Tax Comparison By State For Cross-state Businesses

In One Chart Jersey Citys Seismic Change In Tax Levies Fully Funds The Schools And Reallocates Property Tax Civic Parent

Soon After Taking The Oath Dehraduns New Mayor Sunil Uniyal Gama Hinted To Revise House Tax In The City Property Tax Tax Consulting Tax Payment

Property Tax Map Tax Foundation

State Local Property Tax Collections Per Capita Tax Foundation

Comments

Post a Comment