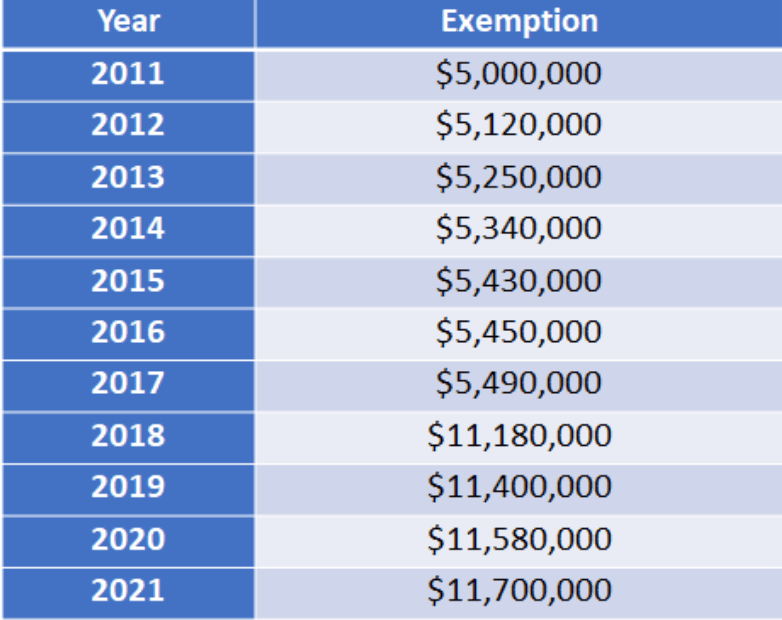

The current exclusion from federal estate and gift tax is $11.7 million ($23.16 million for a married couple). Maybe not tomorrow, but the sunset of our historically high estate tax exemptions is coming—and with the election on its way, it could be sooner than you think.

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

The exemption is subtracted from the value of estate assets, with the result being subject to the estate tax.

When will estate tax exemption sunset. These increased tax exemptions are scheduled to sunset on december 31, 2025. This higher exemption is going to sunset at the end of 2025, falling back to $5 million. This means that a wealthy individual can now gift or bequeath up to $11,580,000 million in assets without being subject to the onerous gift and estate tax regime (death.

As of 2021, the federal estate tax exemption is $11.4 million. The exemption is, in fact, indexed annually for inflation, so it does increase over time. Some proposed legislation has set a $3.5 million exemption while many think it.

The law is set to sunset at the end of 2025, but the impact of a global pandemic and the upcoming presidential election will likely accelerate the rollback. With adjustments for inflation, that exemption in 2020 is $11.58 million, the highest it’s ever been, reports the article “federal estate tax. This raised concerns that the irs could claw back a portion of your gift starting in 2026.

This means that after 2025, exemption levels are scheduled to revert to where they were before the passage of the tcja (indexed for inflation). Dad can shield $17.58 million from the 40% estate. The grantor of the trust has the flexibility to forgive the loan prior to the sunset date and complete the gift.

Federal estate tax exemption sunset is not far off. The 2018 “tax cuts and jobs act” that created the “bonus exclusion” has a “sunset” provision that will cause a reduction of the exclusion to about $6 million ($12 million per couple) for taxpayers dying after december 31, 2025. Said another way, you should keep reading if your estate value exceeds $11,580,000 ($5,790,000 if unmarried).

Mom died in 2020 without using any of her $11.58 estate tax exemption. The window for planning may be closing soon. Federal estate tax exemption sunset is not far off.

Perhaps she left it all to dad under the federal estate tax marital deduction. There’s a timeline for this historically high exemption. Dad dies in 2026 when the exclusion amount is $6 million.

Nothing has happened politically, and the doubling of the estate and gift tax exemption is scheduled to “sunset” on january 1, 2026 (at the end of the 7 th year). The sunset provision of the temporary increase in estate tax exemption you'll note that the title of this blog post references a temporary change. Mom's executor files a timely filed estate tax return and elects portability.

This increase in the estate tax exemption is set to sunset at the end of 2025, meaning the exemption will likely drop back to what it was prior to 2018. However, the favorable estate tax changes in the tcja are currently scheduled to sunset after 2025, unless congress takes further action. Estates in excess of the exclusion are currently taxed at 40%.

In reality, very few estates will pay estate tax. In this insight, i’ll explain what the tcja means for estate and gift taxes and discuss some possible planning and gifting strategies moving forward. With adjustments for inflation, that exemption in 2020 is $11.58 million, the highest it’s ever been, reports the article “federal estate tax exemption is set to expire—are you prepared?” from kiplinger.

You may recall that the 2017 republican tax reform legislation roughly doubled the estate and gift tax exemption. Taxpayers with significant estates were no doubt happy when the estate tax limit was raised to $11,580,000 million from $5,490,000 million in 2017. The current estate and gift tax exemption law sunsets in 2025, and the exemption amount will drop back down to the prior law’s $5 million cap, which when adjusted for inflation is expected to be about $6.2 million.

With Gift Taxes And Estate Taxes In Congress Sights Consider Revisiting Your Estate Planning Northwestern Mutual

Estate Taxes Under Biden Administration May See Changes

He Coming Estate Tax Debate

Locking In A Deceased Spouses Unused Federal Estate Tax Exemption -

Five Tax Planning Questions To Answer Before Year End

High Net-worth Families Should Review Their Estate Plans Pre-election

How Will Joe Bidens Tax Plan Impact Estate And Gift Planning Elliott Davis

The Generation-skipping Transfer Tax A Quick Guide

Thoughtful Gifting Part 1 Use It Or Lose It Now Could Be The Time To Use Your Gift And Estate Tax Exemption

Biden Tax Plan And 2020 Year-end Planning Opportunities

Gift Money Now Before Estate Tax Laws Sunset In 2025 The Wealthadvisor

Will The Lifetime Exemption Sunset On January 1 2026 - Agency One

Will The Lifetime Exemption Sunset On January 1 2026 - Agency One

Sunrise Sunset The Federal Estate Tax Is Back

Estate Tax Exemptions 2020 - Fafinski Mark Johnson Pa

The Incredible Shrinking Estate Tax Tax Policy Center

Sunrise Sunset The Federal Estate Tax Is Back

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc - Jdsupra

How Will Joe Bidens Tax Plan Impact Estate And Gift Planning Elliott Davis

Comments

Post a Comment