Anyone who doesn't fit into class a or b goes here—including, for example, aunts, uncles, cousins, friends, nieces and nephews by marriage, and corporations. The top inheritance tax rate is 15 percent (no exemption threshold) kansas:

All Eyes On Nevada Real Estate For 2018 Tahoe Luxury Properties

If your estate is over the estate tax exemption amount, then your estate will be required to pay a flat 40% estate tax on everything over the threshold.

Indiana estate tax threshold. The tax cuts and jobs act, signed into law in 2017, doubled the exemption for the federal estate tax and indexed that exemption to inflation. No estate tax or inheritance tax The exemption for the federal estate tax is $11.18 million.

The personal representative of an estate in indiana must continue to pay the taxes owed by the decedent and his or her estate. This entire sum is taxed at the federal estate tax rate, which is currently 40%. Increased the threshold for the maryland estate tax to $1.5 million in 2015, $2 million in 2016, $3 million in 2017, and $4 million in 2018.

Estate are required for those dying after december 31, 2012. For 2020, the basic exclusion amount will go up $180,000 from 2019 levels to. Property taxes owed by the decedent

The balance over this amount—$2 million—would therefore be subject to a. Hawaii and delaware have the highest exemption threshold at $5,340,000 (matching the federal exemption). Indiana’s inheritance tax still applies.

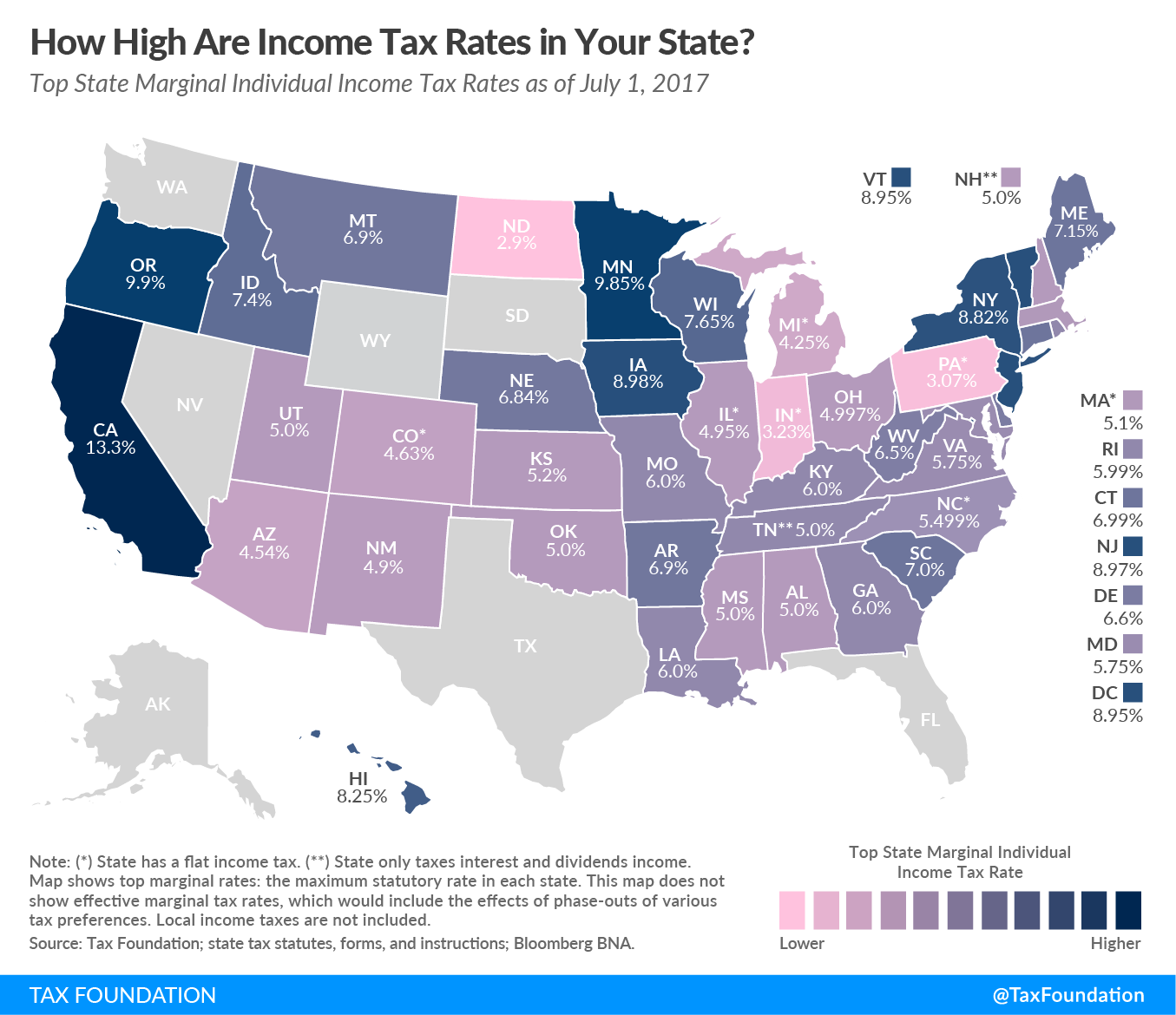

Indiana’s inheritance tax retroactively to january 1, 2013. Reposting policy) the state with the highest maximum estate tax rate is washington (20 percent), followed by eleven states which have a maximum rate of 16 percent. It taxes the entire amount of the estate on estates over that $1 million threshold.

New jersey has the lowest, only exempting estates up to $675,000. This can, however, be avoided through advanced estate planning and protection planning. The tax was repealed, and the repeal was made effective retroactively for deaths as of january 1, 2013.

For individuals dying before january 1, 2013. The federal credit for state death taxes table has a tax rate of 0% for the first $40,000. That means the federal government gets to collect $1.32 million in taxes, leaving a total of $13.68 million for your heirs.

Until may 2013, indiana had a state inheritance tax , which was imposed on certain people who inherit money from an indiana resident. For 2021, the threshold for federal estate taxes is $11.7 million, which is up slightly from $11.58 million in 2020. Understanding the indiana probate process if you cannot avoid probate, an administrator will be named to handle the probate process, which usually takes place in the county where the deceased person lived.

The final income tax return of the decedent; Combined with a top federal rate of 40 percent, some heirs face a tax of up to 56 percent, but the federal estate tax kicks in at just under $12 million while illinois’ estate tax applies to any inherited value above $4 million. For instance, if your taxable estate is $15 million, then after the $11.7 million credit, $3.3 million is taxable.

For married couples, this threshold is doubled, meaning they can protect up to $23.4 million in 2021. That number is used to calculate the size of the credit against estate tax. John's estate would not be liable for the federal estate tax at $3 million because this is well below the $11.7 million federal exemption threshold.

The top estate tax rate is 16 percent (exemption threshold: Schedule, and the fiduciary for the trust or estate must continue to withhold indiana adjusted gross income tax for all nonresident beneficiaries. The higher exemption will expire dec.

In general, estates or beneficiaries of. No estate tax or inheritance tax. This exemption threshold changes according to inflation;

The maximum federal estate tax rate is 40 percent on the value of an estate above that amount. In indiana, these assets will avoid probate if other assets outside the trust exceed the state’s small estate threshold. The estate tax was first levied by the federal government in 1916.

The maximum rate of estate tax is 40 percent. As of january 1, 2012, the exclusion equaled the federal estate tax applicable exclusion amount, so long as the fet exclusion was not less than $2,000,000 and not more than $3,500,000. The top estate tax rate is 16 percent (exemption threshold:

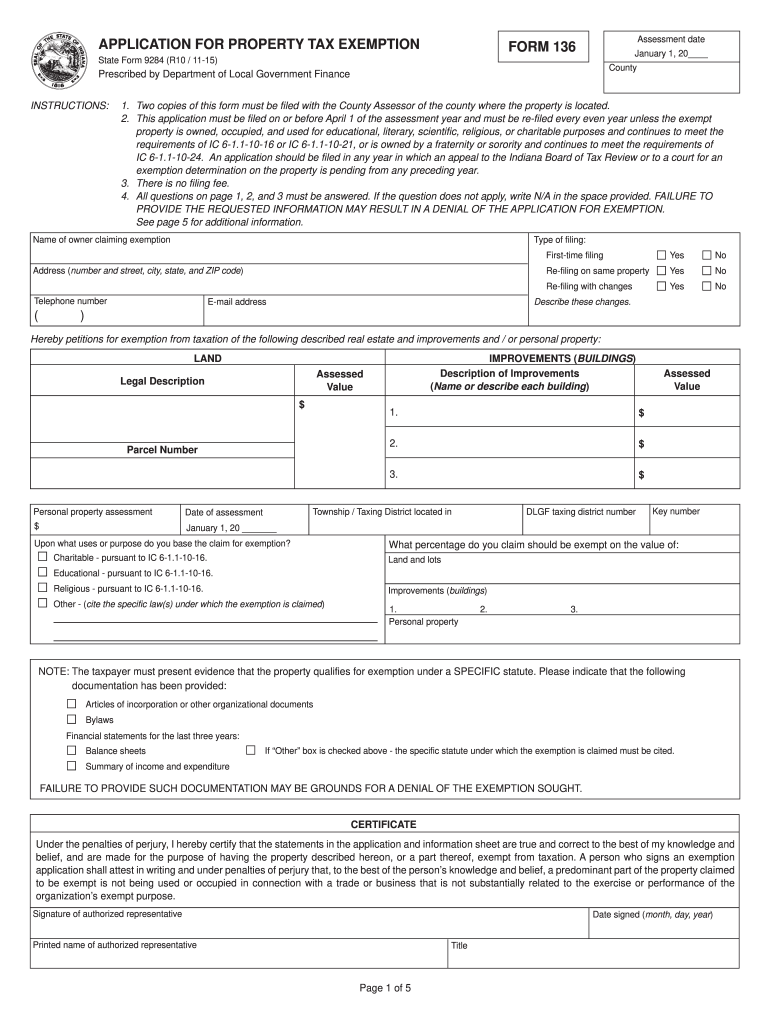

Only $100 is exempt from inheritance tax. Single filers can claim $1,000, while married households can receive a $2,000 exemption. Are required to file an inheritance tax return (form

Most relatively simple estates (cash, publicly traded securities, small amounts of other easily valued assets, and no special deductions or elections, or jointly held property) do not require the filing of an estate tax return. They do not owe inheritance tax unless they inherit more than $500. More than 99.9% of all estates do not owe federal estate tax.

The amount of tax is determined by the value of those. Indiana also has a dependent. but his state's exemption is only $1 million.

However, there are personal exemptionsyou can use to lower your tax liability. In 2010, vermont increased the estate tax exemption threshold from $2,000,000 to $2,750,000 for decedents dying on or after january 1, 2011. This could include cash, real estate, retirement accounts or a range of other assets.

This replaced indiana’s prior law enacted in 2012. As of 2015, only estates with a taxable value of more than $5.43 million were subject to the tax. Though indiana does not have an estate tax, you still may have to pay the federal estate tax if you have enough assets.

No estate tax or inheritance tax. To learn more about some of these strategies visit our asset protection services page. The government established the current exemption level when it passed the tax code in 2017.

Estate income tax through the fiduciary income tax return, if more than $600 was made by the estate; Federal estate tax largely tamed.

Estate Tax Planning In Indiana - Hunter Estate Elder Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2

State Estate And Inheritance Taxes

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Historical Indiana Tax Policy Information - Ballotpedia

Filing Final Tax Returns For The Deceased Comprehensive Retirement Solutions Crs Tax Solutions

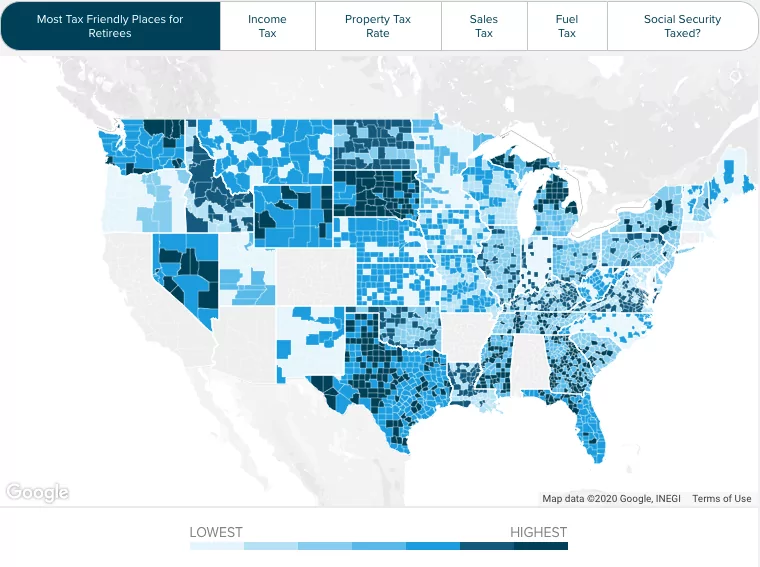

Indiana Retirement Tax Friendliness - Smartasset

2

In State Form 9284 2015-2021 - Fill Out Tax Template Online Us Legal Forms

2021 Estate Income Tax Calculator Rates

The Potential For Major Estate Tax Changes During The Biden Administration What You Need To Know - Inside Indiana Business

Download Instructions For Form Ih-6 Indiana Inheritance Tax Return Pdf Templateroller

Indiana Property Tax Calculator - Smartasset

Indiana Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Indiana Inheritance Tax Free Download

Indiana Retirement Tax Friendliness - Smartasset

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Dor Stages Of Collection

Comments

Post a Comment